Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 45

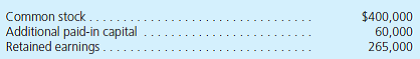

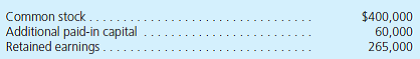

On January 1, 2012, Pierson Corporation exchanged $1,710,000 cash for 90 percent of the outstanding voting stock of Steele Company. The consideration transferred by Pierson provided a reasonable basis for assessing the total January 1, 2012, fair value of Steele Company. At the acquisition date, Steele reported the following owners' equity amounts in its balance sheet:

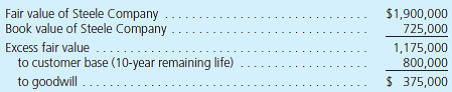

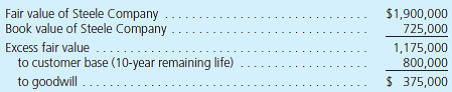

In determining its acquisition offer, Pierson noted that the values for Steele's recorded assets and liabilities approximated their fair values. Pierson also observed that Steele had developed internally a customer base with an assessed fair value of $800,000 that was not reflected on Steele's books. Pierson expected both cost and revenue synergies from the combination.

At the acquisition date, Pierson prepared the following fair-value allocation schedule:

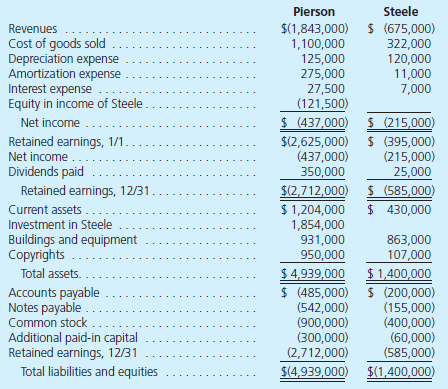

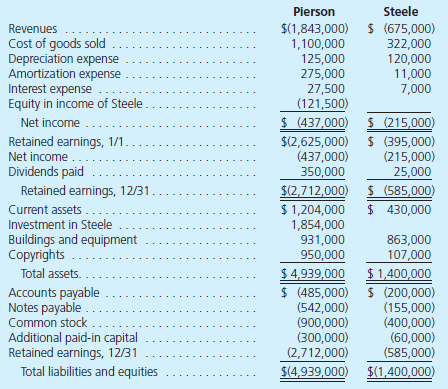

At December 31, 2013, the two companies report the following balances:

a. Determine the consolidated balances for this business combination as of December 31, 2013.

b. If instead the noncontrolling interest's acquisition-date fair value is assessed at $152,500, what changes would be evident in the consolidated statements

In determining its acquisition offer, Pierson noted that the values for Steele's recorded assets and liabilities approximated their fair values. Pierson also observed that Steele had developed internally a customer base with an assessed fair value of $800,000 that was not reflected on Steele's books. Pierson expected both cost and revenue synergies from the combination.

At the acquisition date, Pierson prepared the following fair-value allocation schedule:

At December 31, 2013, the two companies report the following balances:

a. Determine the consolidated balances for this business combination as of December 31, 2013.

b. If instead the noncontrolling interest's acquisition-date fair value is assessed at $152,500, what changes would be evident in the consolidated statements

Explanation

"Consolidated Financial Statement:"

"The...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255