Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 57

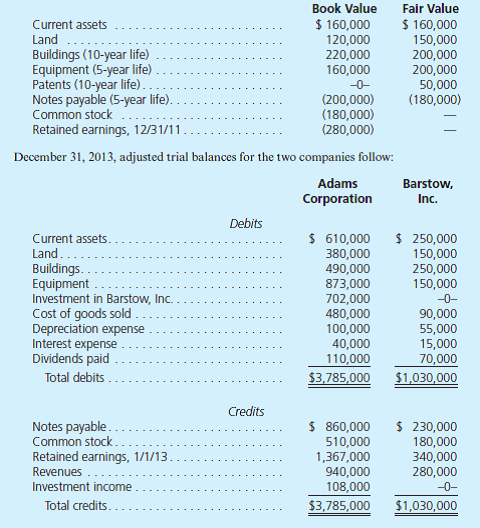

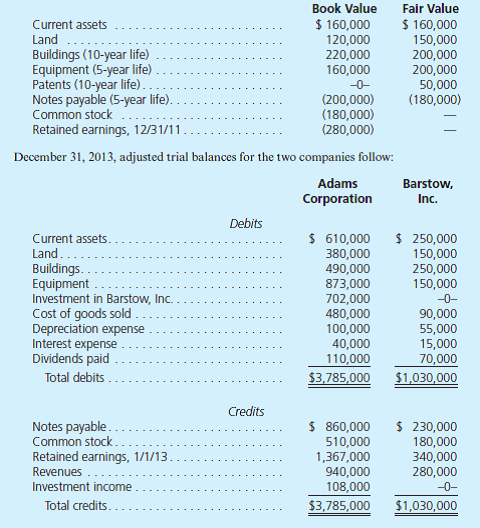

Adams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Inc., on December 31, 2011. Adams paid a total of $603,000 in cash for these shares. The 10 percent noncontrolling interest shares traded on a daily basis at fair value of $67,000 both before and after Adams's acquisition. On December 31, 2011, Barstow had the following account balances:

a. Prepare schedules for acquisition-date fair-value allocations and amortizations for Adams's investment in Barstow.

b. Determine Adams's method of accounting for its investment in Barstow. Support your answer with a numerical explanation.

c. Without using a worksheet or consolidation entries, determine the balances to be reported as of December 31, 2013, for this business combination.

d. To verify the figures determined in requirement ( c ) , prepare a consolidation worksheet for Adams Corporation and Barstow, Inc., as of December 31, 2013.

a. Prepare schedules for acquisition-date fair-value allocations and amortizations for Adams's investment in Barstow.

b. Determine Adams's method of accounting for its investment in Barstow. Support your answer with a numerical explanation.

c. Without using a worksheet or consolidation entries, determine the balances to be reported as of December 31, 2013, for this business combination.

d. To verify the figures determined in requirement ( c ) , prepare a consolidation worksheet for Adams Corporation and Barstow, Inc., as of December 31, 2013.

Explanation

"Consolidated Financial Statement:"

"The...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255