Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 19

Wallton Corporation owns 70 percent of the outstanding stock of Hastings, Incorporated. On January 1, 2011, Wallton acquired a building with a 10-year life for $300,000. Wallton anticipated no salvage value, and the building was to be depreciated on the straight-line basis. On January 1, 2013, Wallton sold this building to Hastings for $280,000. At that time, the building had a remaining life of eight years but still no expected salvage value. In preparing financial statements for 2013, how does this transfer affect the computation of consolidated net income

A) Income must be reduced by $32,000.

B) Income must be reduced by $35,000.

C) Income must be reduced by $36,000.

D) Income must be reduced by $40,000.

Use the following data for problems 10-15:

On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (5-year life) that was undervalued on its books by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000. These formulas, although not recorded on Suarez's financial records, were estimated to have a 20-year future life.

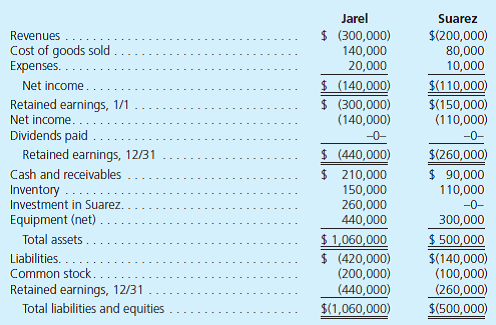

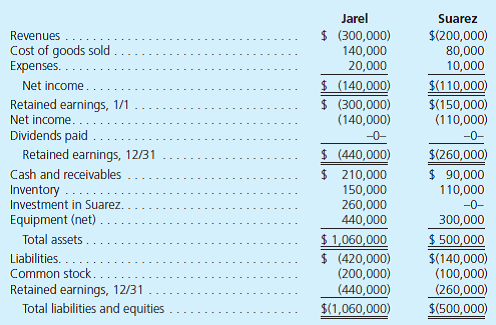

As of December 31, the financial statements appeared as follows:

During the year, Jarel bought inventory for $80,000 and sold it to Suarez for $100,000. Of these goods, Suarez still owns 60 percent on December 31.

A) Income must be reduced by $32,000.

B) Income must be reduced by $35,000.

C) Income must be reduced by $36,000.

D) Income must be reduced by $40,000.

Use the following data for problems 10-15:

On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (5-year life) that was undervalued on its books by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000. These formulas, although not recorded on Suarez's financial records, were estimated to have a 20-year future life.

As of December 31, the financial statements appeared as follows:

During the year, Jarel bought inventory for $80,000 and sold it to Suarez for $100,000. Of these goods, Suarez still owns 60 percent on December 31.

Explanation

Non-depreciable assets like land does no...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255