Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 44

On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (5-year life) that was undervalued on its books by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000. These formulas, although not recorded on Suarez's financial records, were estimated to have a 20-year future life.

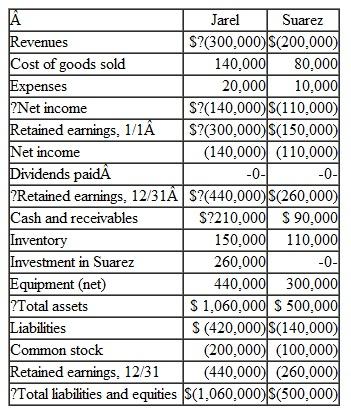

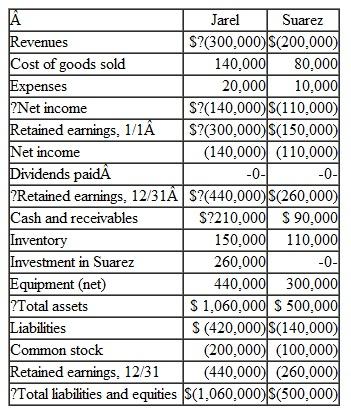

As of December 31, the financial statements appeared as follows:

During the year, Jarel bought inventory for $80,000 and sold it to Suarez for $100,000. Of these goods, Suarez still owns 60 percent on December 31.

What is the consolidated total of noncontrolling interest appearing on the balance sheet

a. $85,500.

b. $83,100.

c. $87,000.

d. $70,500.

As of December 31, the financial statements appeared as follows:

During the year, Jarel bought inventory for $80,000 and sold it to Suarez for $100,000. Of these goods, Suarez still owns 60 percent on December 31.

What is the consolidated total of noncontrolling interest appearing on the balance sheet

a. $85,500.

b. $83,100.

c. $87,000.

d. $70,500.

Explanation

Corporation J owns 80% of the voting sto...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255