Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 62

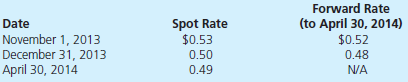

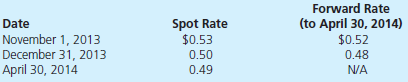

On November 1, 2013, Ambrose Company sold merchandise to a foreign customer for 100,000 FCUs with payment to be received on April 30, 2014. At the date of sale, Ambrose entered into a six-month forward contract to sell 100,000 LCUs. It properly designates the forward contract as a cash flow hedge of a foreign currency receivable. The following exchange rates apply:

Ambrose's incremental borrowing rate is 12 percent. The present value factor for four months at an annual interest rate of 12 percent (1 percent per month) is 0.9610.

A) Prepare all journal entries, including December 31 adjusting entries, to record the sale and forward contract.

B) What is the impact on net income in 2013

C) What is the impact on net income in 2014

Ambrose's incremental borrowing rate is 12 percent. The present value factor for four months at an annual interest rate of 12 percent (1 percent per month) is 0.9610.

A) Prepare all journal entries, including December 31 adjusting entries, to record the sale and forward contract.

B) What is the impact on net income in 2013

C) What is the impact on net income in 2014

Explanation

"In case of global companies there is lo...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255