Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 46

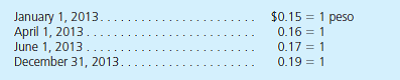

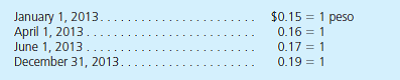

A Clarke Corporation subsidiary buys marketable equity securities and inventory on April 1, 2013, for 100,000 pesos each. It pays for both items on June 1, 2013, and they are still on hand at yearend. Inventory is carried at cost under the lower-of-cost-or-market rule. Currency exchange rates for 1 peso follow:

Assume that the peso is the subsidiary's functional currency. What balances does a consolidated balance sheet report as of December 31, 2013

a. Marketable equity securities 5 $16,000 and Inventory 5 $16,000.

b. Marketable equity securities 5 $17,000 and Inventory 5 $17,000.

c. Marketable equity securities 5 $19,000 and Inventory 5 $16,000.

d. Marketable equity securities 5 $19,000 and Inventory 5 $19,000.

Assume that the peso is the subsidiary's functional currency. What balances does a consolidated balance sheet report as of December 31, 2013

a. Marketable equity securities 5 $16,000 and Inventory 5 $16,000.

b. Marketable equity securities 5 $17,000 and Inventory 5 $17,000.

c. Marketable equity securities 5 $19,000 and Inventory 5 $16,000.

d. Marketable equity securities 5 $19,000 and Inventory 5 $19,000.

Explanation

IAS 21 states that every foreign subsidi...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255