Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 34

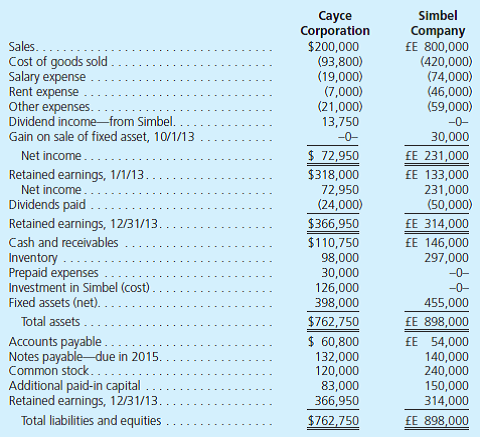

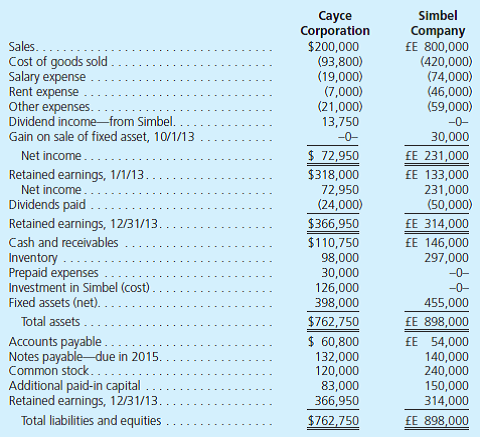

On January 1, 2012, Cayce Corporation acquired 100 percent of Simbel Company for consideration paid of $126,000, which was equal to fair value. Cayce is a U.S.-based company headquartered in Buffalo, New York, and Simbel is in Cairo, Egypt. Cayce accounts for its investment in Simbel under the cost method. Any excess of fair value over book value is attributable to undervalued land on Simbel's books. Simbel had no retained earnings at the date of acquisition. Following are the 2013 financial statements for the two operations. Information for Cayce and for Simbel is in U.S. dollars ($) and Egyptian pounds (LE), respectively.

Additional Information

• During 2012, the first year of joint operation, Simbel reported income of LE 163,000 earned evenly throughout the year. Simbel paid a dividend of LE 30,000 to Cayce on June 1 of that year. Simbel also paid the 2013 dividend on June 1.

• On December 9, 2013, Simbel classified a LE 10,000 expenditure as a rent expense, although this payment related to prepayment of rent for the first few months of 2014.

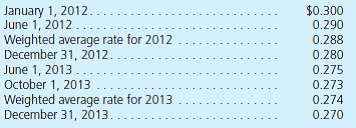

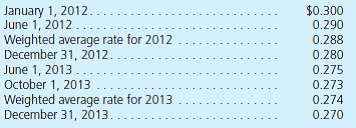

• The exchange rates for 1 LE are as follows:

Translate Simbel's 2013 financial statements into U.S. dollars and prepare a consolidation worksheet for Cayce and its Egyptian subsidiary. Assume that the Egyptian pound is the subsidiary's functional currency.

Additional Information

• During 2012, the first year of joint operation, Simbel reported income of LE 163,000 earned evenly throughout the year. Simbel paid a dividend of LE 30,000 to Cayce on June 1 of that year. Simbel also paid the 2013 dividend on June 1.

• On December 9, 2013, Simbel classified a LE 10,000 expenditure as a rent expense, although this payment related to prepayment of rent for the first few months of 2014.

• The exchange rates for 1 LE are as follows:

Translate Simbel's 2013 financial statements into U.S. dollars and prepare a consolidation worksheet for Cayce and its Egyptian subsidiary. Assume that the Egyptian pound is the subsidiary's functional currency.

Explanation

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255