Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 14

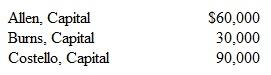

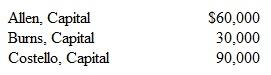

A partnership has the following capital balances:

Profits and losses are split as follows: Allen (20%), Burns (30%), and Costello (50%). Costello wants to leave the partnership and is paid $ 100,000 from the business based on provisions in the articles of partnership. If the partnership uses the bonus method, what is the balance of Burns's capital account after Costello withdraws

A) $24,000.

B) $27,000.

C) $33,000.

D) $36,000.

Profits and losses are split as follows: Allen (20%), Burns (30%), and Costello (50%). Costello wants to leave the partnership and is paid $ 100,000 from the business based on provisions in the articles of partnership. If the partnership uses the bonus method, what is the balance of Burns's capital account after Costello withdraws

A) $24,000.

B) $27,000.

C) $33,000.

D) $36,000.

Explanation

The balance of B's capital account after...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255