Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 29

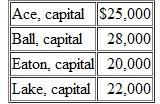

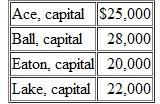

A partnership currently holds three assets: cash, $10,000; land, $35,000; and a building, $50,000. The partners anticipate that expenses required to liquidate their partnership will amount to $5,000. Capital balances are as follows:

The partners share profits and losses as follows: Ace (30%), Ball (30%), Eaton (20%), and Lake (20%). If a preliminary distribution of cash is to be made, how much will each partner receive

The partners share profits and losses as follows: Ace (30%), Ball (30%), Eaton (20%), and Lake (20%). If a preliminary distribution of cash is to be made, how much will each partner receive

Explanation

Given data can be summarized as below:

...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255