Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962 Exercise 14

Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return

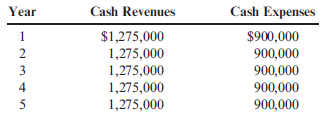

Booth Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $960,000. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Required:

1. Compute the payback period for the NC equipment.

2. Compute the NC equipment's ARR. Round the percentage to one decimal place.

3. Compute the investment's NPV, assuming a required rate of return of 10%.

4. Compute the investment's IRR.

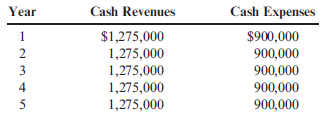

Booth Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $960,000. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Required:

1. Compute the payback period for the NC equipment.

2. Compute the NC equipment's ARR. Round the percentage to one decimal place.

3. Compute the investment's NPV, assuming a required rate of return of 10%.

4. Compute the investment's IRR.

Explanation

Net present value:

Net present value de...

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255