Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962 Exercise 34

Net Present Value versus Internal Rate of Return

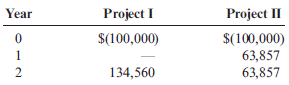

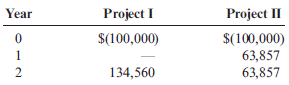

Skiba Company is thinking about two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments follow:

Skiba's cost of capital is 10%.

Required:

1. Compute the NPV and the IRR for each investment.

2. CONCEPTUAL CONNECTION Explain why the project with the larger NPV is the correct choice for Skiba.

Skiba Company is thinking about two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments follow:

Skiba's cost of capital is 10%.

Required:

1. Compute the NPV and the IRR for each investment.

2. CONCEPTUAL CONNECTION Explain why the project with the larger NPV is the correct choice for Skiba.

Explanation

Techniques like Pay-back period, NPV, AR...

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255