Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962 Exercise 50

Net Present Value, Uncertainty

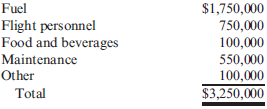

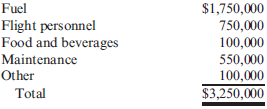

Ondi Airlines is interested in acquiring a new aircraft to service a new route. The route will be from Tulsa to Denver. The aircraft will fly one round-trip daily except for scheduled maintenance days. There are 15 maintenance days scheduled each year. The seating capacity of the aircraft is 150. Flights are expected to be fully booked. The average revenue per passenger per flight (one-way) is $235. Annual operating costs of the aircraft follow:

The aircraft will cost $120,000,000 and has an expected life of 20 years. The company requires a 12% return. Assume there are no income taxes.

Required:

1. Calculate the NPV for the aircraft. Should the company buy it?

2. In discussing the proposal, the marketing manager for the airline believes that the assumption of 100% booking is unrealistic. He believes that the booking rate will be somewhere between 70 and 90%, with the most likely rate being 80%. Recalculate the NPV by using an 80% seating capacity. Should the aircraft be purchased?

3. Calculate the average seating rate that would be needed so that NPV will equal zero. Round the seating rate to the nearest percent.

4. CONCEPTUAL CONNECTION Suppose that the price per passenger could be increased by 10% without any effect on demand. What is the average seating rate now needed to achieve a NPV equal to zero? What would you now recommend? Round the seating rate to the nearest percent.

Ondi Airlines is interested in acquiring a new aircraft to service a new route. The route will be from Tulsa to Denver. The aircraft will fly one round-trip daily except for scheduled maintenance days. There are 15 maintenance days scheduled each year. The seating capacity of the aircraft is 150. Flights are expected to be fully booked. The average revenue per passenger per flight (one-way) is $235. Annual operating costs of the aircraft follow:

The aircraft will cost $120,000,000 and has an expected life of 20 years. The company requires a 12% return. Assume there are no income taxes.

Required:

1. Calculate the NPV for the aircraft. Should the company buy it?

2. In discussing the proposal, the marketing manager for the airline believes that the assumption of 100% booking is unrealistic. He believes that the booking rate will be somewhere between 70 and 90%, with the most likely rate being 80%. Recalculate the NPV by using an 80% seating capacity. Should the aircraft be purchased?

3. Calculate the average seating rate that would be needed so that NPV will equal zero. Round the seating rate to the nearest percent.

4. CONCEPTUAL CONNECTION Suppose that the price per passenger could be increased by 10% without any effect on demand. What is the average seating rate now needed to achieve a NPV equal to zero? What would you now recommend? Round the seating rate to the nearest percent.

Explanation

NPV measures the profitability of a proj...

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255