Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962 Exercise 12

Leverage Ratios

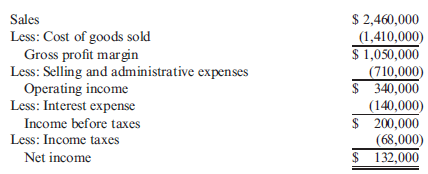

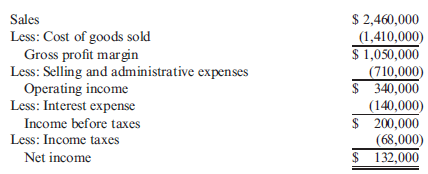

Grammatico Company has just completed its third year of operations. The income statement is as follows:

Selected information from the balance sheet is as follows:

Required:

Note: Round answers to two decimal places.

1. Compute the times-interest-earned ratio.

2. Compute the debt ratio.

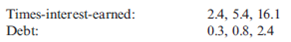

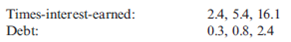

3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammatico's industry are as follows:

How does Grammatico compare with the industrial norms? Does it have too much debt?

Grammatico Company has just completed its third year of operations. The income statement is as follows:

Selected information from the balance sheet is as follows:

Required:

Note: Round answers to two decimal places.

1. Compute the times-interest-earned ratio.

2. Compute the debt ratio.

3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammatico's industry are as follows:

How does Grammatico compare with the industrial norms? Does it have too much debt?

Explanation

Calculate Times-interest-earned ratio:

...

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255