Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Edition 6ISBN: 978-1305103962 Exercise 38

Profitability Ratios

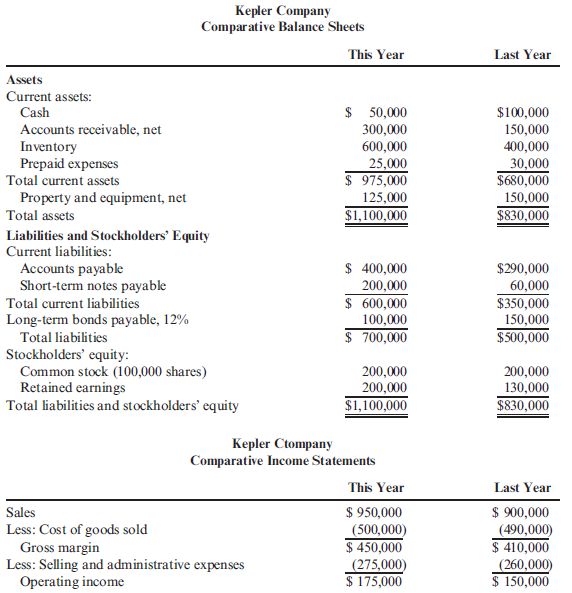

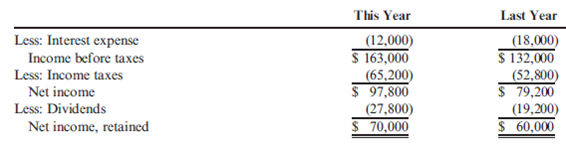

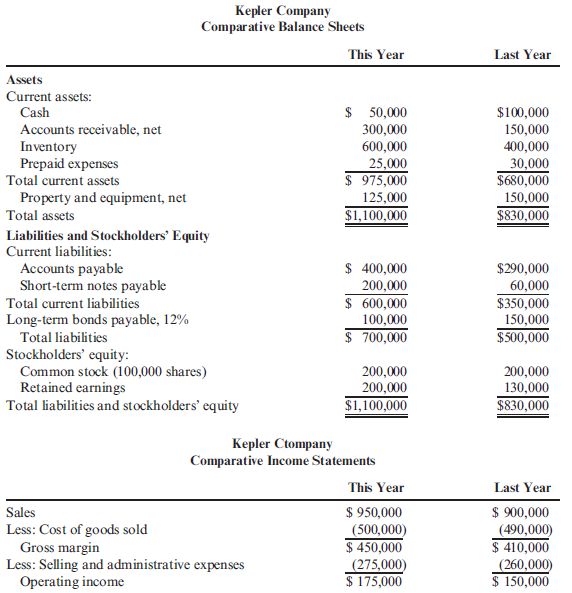

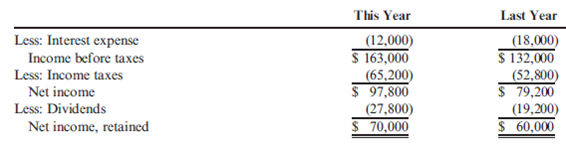

Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the company's financial statements for the 2 most recent years.

Refer to the information for Kepler Company above. Also, assume that for last year and for the current year, the market price per share of common stock is $2.98. In addition, for last year, assets and equity were the same at the beginning and end of the year.

Required :

Note : Round all answers to two decimal places.

1. Compute the following for each year: (a) return on assets, (b) return on stockholders' equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f) dividend payout.

2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?

Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the company's financial statements for the 2 most recent years.

Refer to the information for Kepler Company above. Also, assume that for last year and for the current year, the market price per share of common stock is $2.98. In addition, for last year, assets and equity were the same at the beginning and end of the year.

Required :

Note : Round all answers to two decimal places.

1. Compute the following for each year: (a) return on assets, (b) return on stockholders' equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f) dividend payout.

2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Cornerstones of Managerial Accounting 6th Edition by Maryanne Mowen,Don Hansen ,Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255