Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 52

Aging of receivables; estimating allowance for doubtful accounts

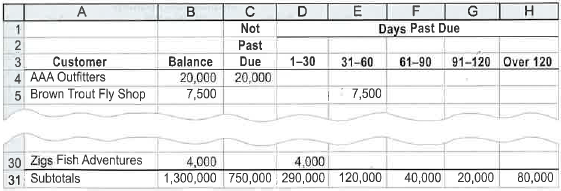

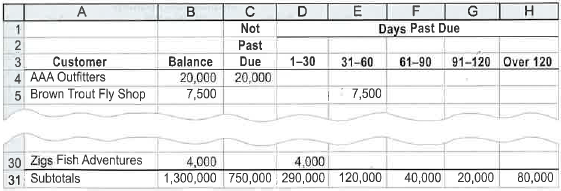

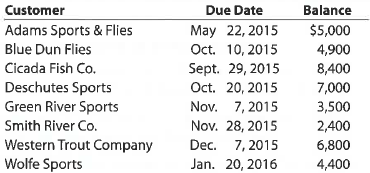

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy Fish prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 2015:

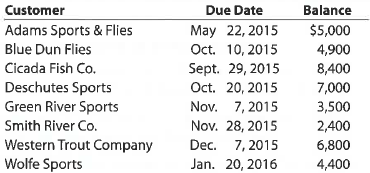

The following accounts were unintentionally omitted from the aging schedule:

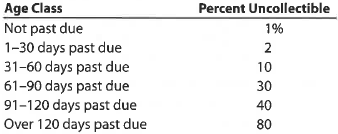

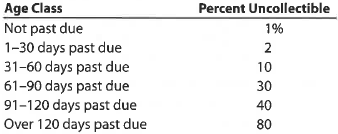

Trophy Fish has a past history of uncollectible accounts by age category, as follows:

Instructions

1. Determine the number of days past due for each of the preceding accounts.

2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31, 2015. Journalize the adjusting entry for uncollectible accounts.

5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy Fish prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 2015:

The following accounts were unintentionally omitted from the aging schedule:

Trophy Fish has a past history of uncollectible accounts by age category, as follows:

Instructions

1. Determine the number of days past due for each of the preceding accounts.

2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31, 2015. Journalize the adjusting entry for uncollectible accounts.

5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement

Explanation

1.Number of days past due is the number ...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255