Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 56

Payroll accounts and year-end entries

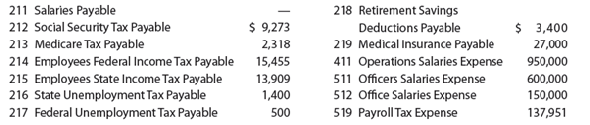

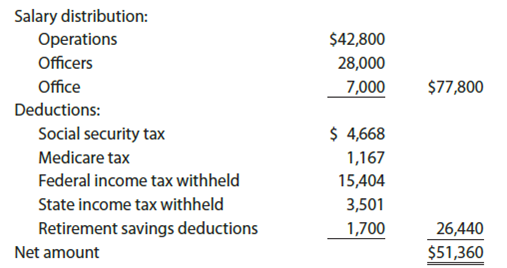

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

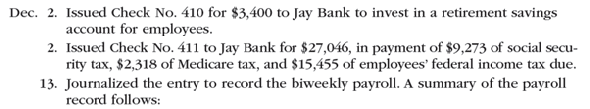

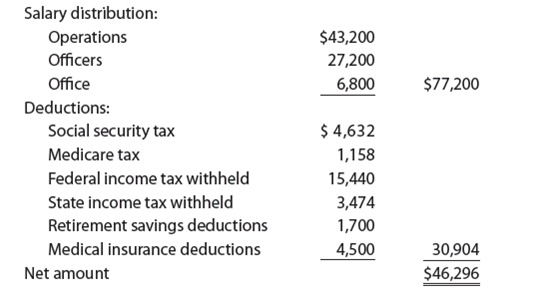

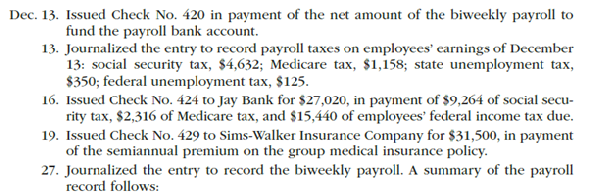

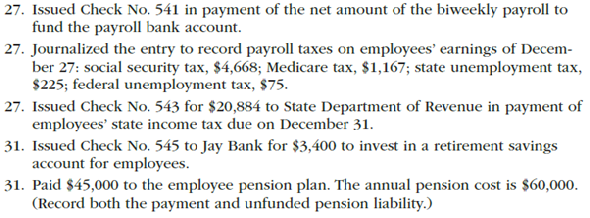

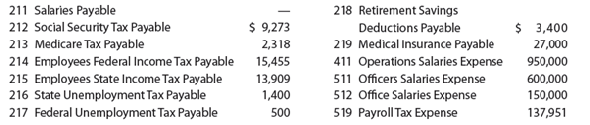

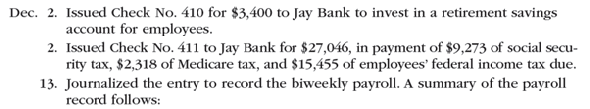

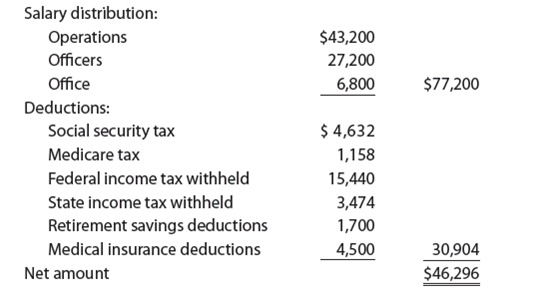

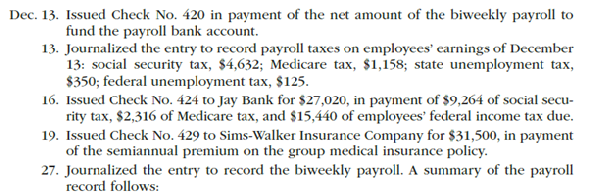

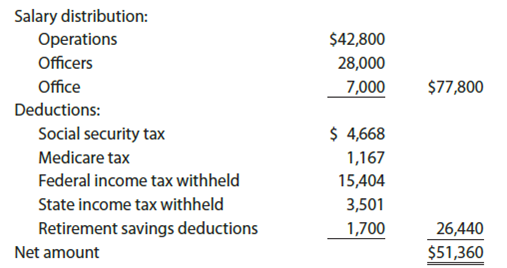

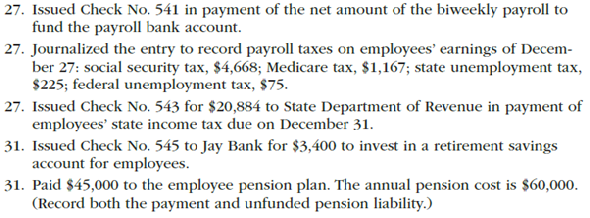

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

Instructions

1. Journalize the transactions.

2. Journalize the following adjusting entries on December 31:

a. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries, $1,400. The payroll taxes are immaterial and are not accrued.

b. Vacation pay, $15,000.

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

Instructions

1. Journalize the transactions.

2. Journalize the following adjusting entries on December 31:

a. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries, $1,400. The payroll taxes are immaterial and are not accrued.

b. Vacation pay, $15,000.

Explanation

Journal entry forms the basis of an acco...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255