Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 58

Entries and balance sheet for partnership

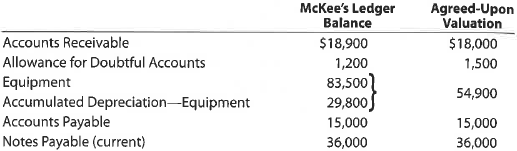

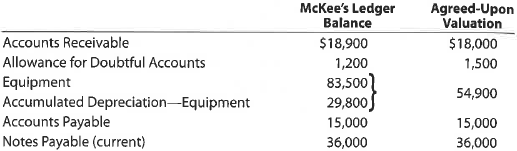

On March 1, 2016, Eric Keene and Abigail McKee form a partnership. Keene agrees to invest $21,100 in cash and merchandise inventory valued at $55,900. McKee invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $60,000. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow:

The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $22,500 (Keene) and $30,400 (McKee), and the remainder equally.

Instructions

1. Journalize the entries to record the investments of Keene and McKee in the partnership accounts.

2. Prepare a balance sheet as of March 1, 2016, the date of formation of the partnership of Keene and McKee.

3. After adjustments and the closing of revenue and expense accounts at February 28, 2017, the end of the first full year of operations, the income summary account has a credit balance of $90,000, and the drawing accounts have debit balances of $28,000 (Keene) and $30,400 (McKee). Journalize the entries to close the income summary account and the drawing accounts at February 28, 2017.

On March 1, 2016, Eric Keene and Abigail McKee form a partnership. Keene agrees to invest $21,100 in cash and merchandise inventory valued at $55,900. McKee invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $60,000. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow:

The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $22,500 (Keene) and $30,400 (McKee), and the remainder equally.

Instructions

1. Journalize the entries to record the investments of Keene and McKee in the partnership accounts.

2. Prepare a balance sheet as of March 1, 2016, the date of formation of the partnership of Keene and McKee.

3. After adjustments and the closing of revenue and expense accounts at February 28, 2017, the end of the first full year of operations, the income summary account has a credit balance of $90,000, and the drawing accounts have debit balances of $28,000 (Keene) and $30,400 (McKee). Journalize the entries to close the income summary account and the drawing accounts at February 28, 2017.

Explanation

1.Journalize the entries to record the i...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255