Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402 Exercise 41

Quality Improvement and Profitability Objective

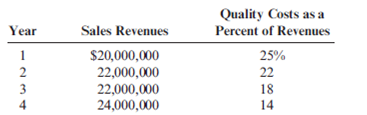

Gagnon Company reported the following sales and quality costs for the past four years. Assume that all quality costs are variable and that all changes in the quality cost ratios are due to a quality improvement program.

Required:

1. Compute the quality costs for all four years. By how much did net income increase from Year 1 to Year 2 because of quality improvements? From Year 2 to Year 3? From Year 3 to Year 4?

2. The management of Gagnon Company believes it is possible to reduce quality costs to 2.5 percent of sales. Assuming sales will continue at the Year 4 level, calculate the additional profit potential facing Gagnon. Is the expectation of improving quality and reducing costs to 2.5 percent of sales realistic? Explain.

3. Assume that Gagnon produces one type of product, which is sold on a bid basis. In Years 1 and 2, the average bid was $400. In Year 1, total variable costs were $250 per unit. In Year 3, competition forced the bid to drop to $380. Compute the total contribution margin in Year 3 assuming the same quality costs as in Year 1. Now, compute the total contribution margin in Year 3 using the actual quality costs for Year 3. What is the increase in profitability resulting from the quality improvements made from Year 1 to Year 3?

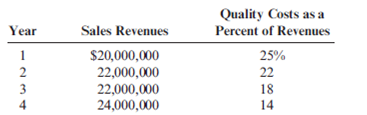

Gagnon Company reported the following sales and quality costs for the past four years. Assume that all quality costs are variable and that all changes in the quality cost ratios are due to a quality improvement program.

Required:

1. Compute the quality costs for all four years. By how much did net income increase from Year 1 to Year 2 because of quality improvements? From Year 2 to Year 3? From Year 3 to Year 4?

2. The management of Gagnon Company believes it is possible to reduce quality costs to 2.5 percent of sales. Assuming sales will continue at the Year 4 level, calculate the additional profit potential facing Gagnon. Is the expectation of improving quality and reducing costs to 2.5 percent of sales realistic? Explain.

3. Assume that Gagnon produces one type of product, which is sold on a bid basis. In Years 1 and 2, the average bid was $400. In Year 1, total variable costs were $250 per unit. In Year 3, competition forced the bid to drop to $380. Compute the total contribution margin in Year 3 assuming the same quality costs as in Year 1. Now, compute the total contribution margin in Year 3 using the actual quality costs for Year 3. What is the increase in profitability resulting from the quality improvements made from Year 1 to Year 3?

Explanation

Quality Cost Report : Quality costs are ...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255