Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402 Exercise 34

Basic CVP Concepts

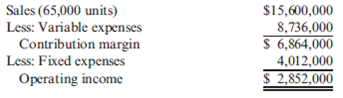

Katayama Company produces a variety of products. One division makes neoprene wetsuits. The division's projected income statement for the coming year is as follows:

Required:

1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio.

2. The divisional manager has decided to increase the advertising budget by $140,000 and cut the average selling price to $200. These actions will increase sales revenues by $1 million. Will this improve the division's financial situation? Prepare a new income statement to support your answer.

3. Suppose sales revenues exceed the estimated amount on the income statement by $612,000. Without preparing a new income statement, determine by how much profits are underestimated.

4. How many units must be sold to earn an after-tax profit of $1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.)

5. Compute the margin of safety in dollars based on the given income statement.

6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?

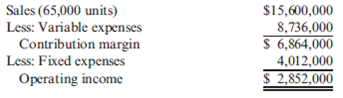

Katayama Company produces a variety of products. One division makes neoprene wetsuits. The division's projected income statement for the coming year is as follows:

Required:

1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio.

2. The divisional manager has decided to increase the advertising budget by $140,000 and cut the average selling price to $200. These actions will increase sales revenues by $1 million. Will this improve the division's financial situation? Prepare a new income statement to support your answer.

3. Suppose sales revenues exceed the estimated amount on the income statement by $612,000. Without preparing a new income statement, determine by how much profits are underestimated.

4. How many units must be sold to earn an after-tax profit of $1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.)

5. Compute the margin of safety in dollars based on the given income statement.

6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?

Explanation

1.Compute contribution margin per unit: ...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255