Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402 Exercise 1

Costs of Different Customer Classes

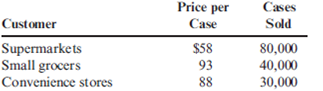

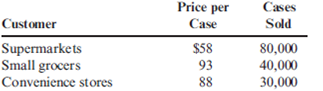

Kaune Food Products Company manufactures canned mixed nuts with an average manufacturing cost of $52 per case (a case contains 24 cans of nuts). Kaune sold 150,000 cases last year to the following three classes of customer:

The supermarkets require special labeling on each can costing $0.04 per can. They order through electronic data interchange (EDI), which costs Kaune about $61,000 annually in operating expenses and depreciation. Kaune delivers the nuts to the stores and stocks them on the shelves. This distribution costs $45,000 per year.

The small grocers order in smaller lots that require special picking and packing in the factory; the special handling adds $25 to the cost of each case sold. Sales commissions to the independent jobbers who sell Kaune products to the grocers average 8 percent of sales. Bad debts expense amounts to 9 percent of sales.

Convenience stores also require special handling that costs $30 per case. In addition, Kaune is required to co-pay advertising costs with the convenience stores at a cost of $15,000 per year. Frequent stops are made to each convenience store by Kaune delivery trucks at a cost of $30,000 per year.

Required:

1. Calculate the total cost per case for each of the three customer classes. (Round unit costs to four significant digits.)

2. Using the costs from Requirement 1, calculate the profit per case per customer class. Does the cost analysis support the charging of different prices? Why or why not?

3. What if Kaune charged the average price per case to all customer classes? How would that affect the profit percentages?

Kaune Food Products Company manufactures canned mixed nuts with an average manufacturing cost of $52 per case (a case contains 24 cans of nuts). Kaune sold 150,000 cases last year to the following three classes of customer:

The supermarkets require special labeling on each can costing $0.04 per can. They order through electronic data interchange (EDI), which costs Kaune about $61,000 annually in operating expenses and depreciation. Kaune delivers the nuts to the stores and stocks them on the shelves. This distribution costs $45,000 per year.

The small grocers order in smaller lots that require special picking and packing in the factory; the special handling adds $25 to the cost of each case sold. Sales commissions to the independent jobbers who sell Kaune products to the grocers average 8 percent of sales. Bad debts expense amounts to 9 percent of sales.

Convenience stores also require special handling that costs $30 per case. In addition, Kaune is required to co-pay advertising costs with the convenience stores at a cost of $15,000 per year. Frequent stops are made to each convenience store by Kaune delivery trucks at a cost of $30,000 per year.

Required:

1. Calculate the total cost per case for each of the three customer classes. (Round unit costs to four significant digits.)

2. Using the costs from Requirement 1, calculate the profit per case per customer class. Does the cost analysis support the charging of different prices? Why or why not?

3. What if Kaune charged the average price per case to all customer classes? How would that affect the profit percentages?

Explanation

1. The total cost per case for each of t...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255