Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402 Exercise 37

NPV

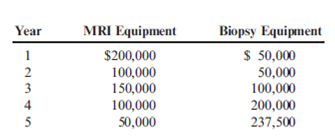

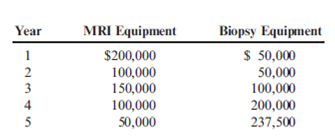

A clinic is considering the possibility of two new purchases: new MRI equipment and new biopsy equipment. Each project requires an investment of $425,000. The expected life for each is five years with no expected salvage value. The net cash inflows associated with the two independent projects are as follows:

Required:

Compute the net present value of each project, assuming a required rate of 12 percent.

A clinic is considering the possibility of two new purchases: new MRI equipment and new biopsy equipment. Each project requires an investment of $425,000. The expected life for each is five years with no expected salvage value. The net cash inflows associated with the two independent projects are as follows:

Required:

Compute the net present value of each project, assuming a required rate of 12 percent.

Explanation

The net present value (NPV) is the prese...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255