Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402 Exercise 20

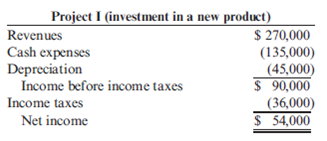

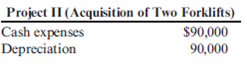

Computation of After-Tax Cash Flows

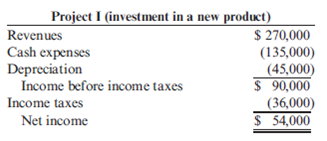

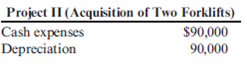

Postman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows:

Required:

Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.

Postman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows:

Required:

Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.

Explanation

Calculate After tax cash flows...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255