Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Edition 2ISBN: 978-1111824402 Exercise 15

NPV, Make or Buy, MACRS, Basic Analysis

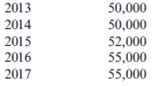

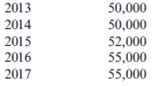

Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows:

The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of $945,000 with terms of 2/10, n/30; the company's policy is to take all purchase discounts. The freight on the equipment would be $11,000, and installation costs would total $22,900. The equipment would be purchased in December 2012 and placed into service on January 1, 2013. It would have a fiveyear economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of $12,000 at the end of its economic life in 2017. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of $2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition.

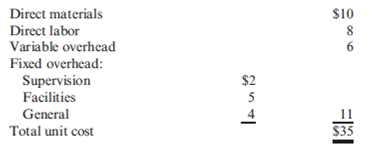

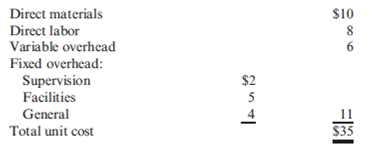

The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of $1,500. Rather than replace the equipment, one of Jonfran's production managers has suggested that the waste containers be purchased. One supplier has quoted a price of $27 per container. This price is $8 less than Jonfran's current manufacturing cost, which is as follows:

Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at $45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment.

Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate.

Required:

1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative.

2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative.

3. Which should Jonfran do-make or buy the containers? What qualitative factors should be considered? ( CMA adapted )

Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows:

The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of $945,000 with terms of 2/10, n/30; the company's policy is to take all purchase discounts. The freight on the equipment would be $11,000, and installation costs would total $22,900. The equipment would be purchased in December 2012 and placed into service on January 1, 2013. It would have a fiveyear economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of $12,000 at the end of its economic life in 2017. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of $2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition.

The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of $1,500. Rather than replace the equipment, one of Jonfran's production managers has suggested that the waste containers be purchased. One supplier has quoted a price of $27 per container. This price is $8 less than Jonfran's current manufacturing cost, which is as follows:

Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at $45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment.

Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate.

Required:

1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative.

2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative.

3. Which should Jonfran do-make or buy the containers? What qualitative factors should be considered? ( CMA adapted )

Explanation

1.Schedule of Cash flows for the make al...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255