Ethical Obligations and Decision-Making in Accounting: Text and Cases 3rd Edition by Steven Mintz,Roselyn Morris

Edition 3ISBN: 978-0077862213

Ethical Obligations and Decision-Making in Accounting: Text and Cases 3rd Edition by Steven Mintz,Roselyn Morris

Edition 3ISBN: 978-0077862213 Exercise 1

Computer Associates

Computer Associates (CA) is a business consulting and software development company that designs, markets, and licenses computer software products that allow businesses to run and manage critical aspects of their information technology efficiently. CA's stock trades on the NYSE and is registered pursuant to Section 12(b) of the Exchange Act, 15 U.S.C. §78l(b).

Between about the fourth quarter of fiscal year (FY) 1998 through the second quarter of FY2001, CA engaged in a widespread practice that allowed for the premature recognition of revenue from software licensing agreements. CA personnel recorded, into the just-elapsed fiscal quarter, revenue from software contracts that were not finalized and signed by both CA and its customers until days or weeks after that quarter ended. The reported revenue was improper because it violated GAAP, which required that license agreements be fully executed by both CA and its customers by quarter end before recognizing revenue. CA's reported revenue and earnings per share (EPS) appeared to meet or exceed Wall Street analysts' expectations, when-in truth and fact-those results were based in part on revenue that CA recognized prematurely and in violation of GAAP. 1

Audit Committee Investigation

In 2003, CA announced that the Audit Committee of its Board of Directors was conducting an investigation into the timing of revenue recognition at the company. On April 26, 2004, CA filed with the SEC a Form 8-K ("Form 8-K") stating, among other things, that:

"The Audit Committee's investigation found accounting irregularities that led to material misstatements of the Company's financial reports for fiscal years 2000 and 2001, and prior periods. The effect of prior period errors which have an impact on fiscal year 2000 have been considered as part of this restatement. The Audit Committee believes that several factors contributed to the improper recognition of revenue in these periods, including a practice of holding the financial period open after the end of the fiscal quarters, providing customers with contracts with preprinted signature dates, late countersignatures by Company personnel, backdating of contracts, and not having sufficient controls to ensure the proper accounting. In addition, the Audit Committee found that certain former executives and other personnel were engaged in the practice of "cleaning up" contracts by, among other things, removing fax time stamps before providing agreements to the outside auditors. These same executives and personnel also misled the Company's outside counsel, the Audit Committee and its counsel and accounting advisers regarding these accounting practices."

Also in the Form 8-K, CA announced that it was restating over $2.2 billion in revenue that CA had recognized improperly in FY2000 and FY2001.

Improper Revenue Recognition at CA

From at least the fourth quarter of FY1998 through the second quarter of FY2001, CA derived its income primarily from licensing software and providing maintenance for that software. CA's software operated and maintained powerful "mainframe" computers, those generally used by businesses and other organizations. Prior to October 2000, CA's contract and licensing model involved entering into long-term licensing contracts, some as long as seven years in duration. Under that business model, customers paid an initial licensing fee for the software, plus subsequent licensing fees for the right to use the software in subsequent years. In addition, customers paid CA for ongoing maintenance, such as technical support. Customers often entered into long-term contracts and spread out the licensing and maintenance fees over the term of the contract.

For contracts under its pre-October 2000 business model, GAAP allowed CA to recognize all the license revenue called for during the duration of the contract up front, during the fiscal quarter in which the software was shipped and the contract was executed and final.

SOP 97-2 , 2 which the AICPA adopted in October 1997, requires the following before revenue can be recognized from a software sale:

• Evidence of an arrangement

• Delivery

• Fixed and determinable fees

• Ability to collect

When a software company uses contracts requiring signatures by the software company and its customer, then SOP 97-2 provides that both signatures-the software company and the customer-are required as "evidence of an arrangement" before the software company may recognize revenue. During the period in question, all CA's license agreements required signatures by both CA and the customer.

Materially False Statements and Omissions in Filings with the SEC

During at least the fourth quarter of FY1998 through the second quarter of FY2001, CA violated GAAP, including SOP 97-2 , by backdating software contracts into prior fiscal quarters expired software contracts that were not executed-and for which "evidence of an arrangement" did not exist-until a subsequent quarter. This extended quarters practice resulted in CA's premature recognition of revenue. As a consequence, CA made material misrepresentations and omissions of fact concerning CA's revenues and earnings for the fourth quarter of FY1998 through the second quarter of FY2001 in various public documents and in connection with the offer, purchase, and sale of securities. CA's reported results for at least the fourth quarter of FY1998 through the fourth quarter of FY2000 appeared to meet or exceed the revenue and earnings estimates of outside analysts when, in fact, those reported results did not comply with GAAP and were false and misleading.

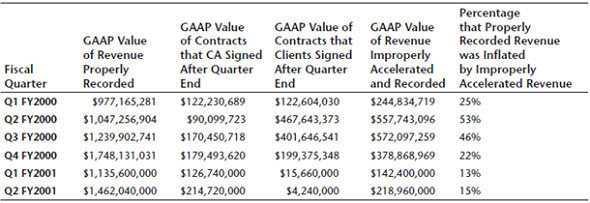

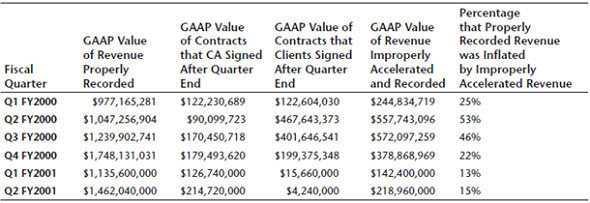

In its Form 8-K, which was not an audited restatement, CA admits that the extended quarters practice resulted in CA prematurely recognizing substantial percentages of revenue for all quarters of FY2000 and the first two quarters of FY2001. The following chart illustrates the impact of the premature revenue recognition in each fiscal quarter:

The greatest amount of prematurely recognized revenue as a result of the extended quarters practice occurred in FY2000, particularly in the third quarter, followed by the second, fourth and first quarters of that fiscal year. If CA had not improperly recognized revenue in each of those fiscal quarters, CA would not have met analysts' revenue and earnings estimates.

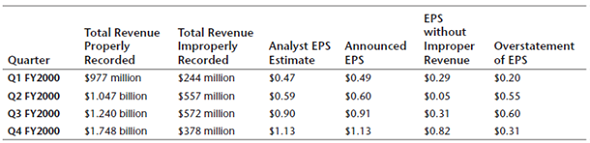

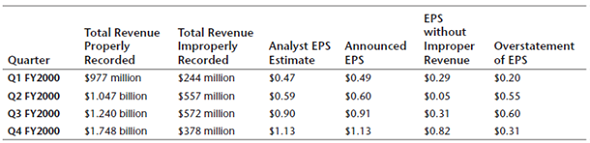

The following is a chart which shows the impact of the extended quarters practice on CA's earnings per share in the four quarters of FY2000 and the extent of the material misstatements and misrepresentations in the Forms 10-Q and Form 10-K that CA filed with the SEC which reported each quarterly result, and related public statements made by CA:

A Systemic and Intentional Practice

The premature recognition of revenue at CA during at least the fourth quarter of FY1998 through the second quarter of FY2001 was the result of a systemic, intentional practice by certain CA personnel. To implement and conceal this extended quarters practice, CA personnel employed a variety of improper techniques, many of which rendered the company's books and records false and misleading, including:

• Some employees at CA called the extended quarters practice the "35-day month" practice, because generally most quarters were extended by at least 3 business days, although some quarterly extensions lasted longer.

• Sometimes CA had its customers execute contracts bearing preprinted dates from the just-expired quarter, even though the customer did not actually sign the contract until days or weeks into the new quarter.

CA substantially stopped prematurely recognizing revenue for software contracts signed after quarter end by CA's customers during the first quarter of FY2001 (quarter ended June 30, 2000). That quarter, CA missed its Wall Street earnings estimates. CA issued a press release on July 3, 2000, stating that it would miss the analysts' estimates, specifically citing the fact that the company did not complete several large contracts that they had hoped to conclude before the close of the quarter. This was only the second time in CA's then-recent history that CA missed Wall Street's estimates. The next trading day, July 5, 2000, CA's share price dropped over 43 percent, from $51.12 to $28.50, as the market reacted to the news. The share price has not recovered and closed at $26.26 on June 14, 2013.

CA continued to recognize revenue prematurely from contracts that CA signed after quarter end (although, with a few exceptions, the customer did sign the contract by quarter end) for the first two quarters of FY2001, after which that practice substantially stopped.

Legal Matters Resolved

In September 2004, CA agreed to pay $225 million in restitution to shareholders to settle the civil case brought by the SEC and to defer criminal charges by the U.S. Department of Justice. At the same time, a federal grand jury brought criminal charges against former CA chairman and CEO Sanjay Kumar. Kumar resigned in April 2004 following an investigation into securities fraud and obstruction of justice at CA. A federal grand jury in Brooklyn indicted him on fraud charges on September 22, 2004. Kumar pled guilty to obstruction of justice and securities fraud charges on April 24, 2006. On November 2, 2006, he was sentenced to 12 years in prison and fined $8 million for his role in the massive accounting fraud at CA. Kumar is currently housed at the Federal Correctional Institution in Miami, Florida, with a projected release date of January 25, 2018.

Questions

1. Analyze each revenue recognition technique identified in the audit committee investigation and explain whether each technique violates revenue recognition rules in accounting. Evaluate the practices followed by CA from an ethical perspective.

2. CA executives were not accused of reporting nonexistent deals or hiding major flaws in the business. The contracts that were backdated by a few days were real. Was this really a crime, or should it fall under the heading of "no harm, no foul"? Be sure to use ethical reasoning in responding to the question.

3. In her "Seven Signs of Ethical Collapse," which were discussed in Chapter 3, Marianne Jennings listed "pressure to maintain the numbers" as the number one sign. How can a company like CA resist such pressure?

1 The material in this case is taken from the SEC complaint against CA that can be found at http://www.sec.gov/litigation/complaints/comp18891-cai.pdf.

2 SOPs are pronouncements on specific accounting matters that had been issued by the AICPA's Accounting Standards Division from 1974 to 2009. The FASB GAAP Codification of authoritative accounting standards issued in 2009 supersedes existing sources of US GAAP including Statements of Position.

Computer Associates (CA) is a business consulting and software development company that designs, markets, and licenses computer software products that allow businesses to run and manage critical aspects of their information technology efficiently. CA's stock trades on the NYSE and is registered pursuant to Section 12(b) of the Exchange Act, 15 U.S.C. §78l(b).

Between about the fourth quarter of fiscal year (FY) 1998 through the second quarter of FY2001, CA engaged in a widespread practice that allowed for the premature recognition of revenue from software licensing agreements. CA personnel recorded, into the just-elapsed fiscal quarter, revenue from software contracts that were not finalized and signed by both CA and its customers until days or weeks after that quarter ended. The reported revenue was improper because it violated GAAP, which required that license agreements be fully executed by both CA and its customers by quarter end before recognizing revenue. CA's reported revenue and earnings per share (EPS) appeared to meet or exceed Wall Street analysts' expectations, when-in truth and fact-those results were based in part on revenue that CA recognized prematurely and in violation of GAAP. 1

Audit Committee Investigation

In 2003, CA announced that the Audit Committee of its Board of Directors was conducting an investigation into the timing of revenue recognition at the company. On April 26, 2004, CA filed with the SEC a Form 8-K ("Form 8-K") stating, among other things, that:

"The Audit Committee's investigation found accounting irregularities that led to material misstatements of the Company's financial reports for fiscal years 2000 and 2001, and prior periods. The effect of prior period errors which have an impact on fiscal year 2000 have been considered as part of this restatement. The Audit Committee believes that several factors contributed to the improper recognition of revenue in these periods, including a practice of holding the financial period open after the end of the fiscal quarters, providing customers with contracts with preprinted signature dates, late countersignatures by Company personnel, backdating of contracts, and not having sufficient controls to ensure the proper accounting. In addition, the Audit Committee found that certain former executives and other personnel were engaged in the practice of "cleaning up" contracts by, among other things, removing fax time stamps before providing agreements to the outside auditors. These same executives and personnel also misled the Company's outside counsel, the Audit Committee and its counsel and accounting advisers regarding these accounting practices."

Also in the Form 8-K, CA announced that it was restating over $2.2 billion in revenue that CA had recognized improperly in FY2000 and FY2001.

Improper Revenue Recognition at CA

From at least the fourth quarter of FY1998 through the second quarter of FY2001, CA derived its income primarily from licensing software and providing maintenance for that software. CA's software operated and maintained powerful "mainframe" computers, those generally used by businesses and other organizations. Prior to October 2000, CA's contract and licensing model involved entering into long-term licensing contracts, some as long as seven years in duration. Under that business model, customers paid an initial licensing fee for the software, plus subsequent licensing fees for the right to use the software in subsequent years. In addition, customers paid CA for ongoing maintenance, such as technical support. Customers often entered into long-term contracts and spread out the licensing and maintenance fees over the term of the contract.

For contracts under its pre-October 2000 business model, GAAP allowed CA to recognize all the license revenue called for during the duration of the contract up front, during the fiscal quarter in which the software was shipped and the contract was executed and final.

SOP 97-2 , 2 which the AICPA adopted in October 1997, requires the following before revenue can be recognized from a software sale:

• Evidence of an arrangement

• Delivery

• Fixed and determinable fees

• Ability to collect

When a software company uses contracts requiring signatures by the software company and its customer, then SOP 97-2 provides that both signatures-the software company and the customer-are required as "evidence of an arrangement" before the software company may recognize revenue. During the period in question, all CA's license agreements required signatures by both CA and the customer.

Materially False Statements and Omissions in Filings with the SEC

During at least the fourth quarter of FY1998 through the second quarter of FY2001, CA violated GAAP, including SOP 97-2 , by backdating software contracts into prior fiscal quarters expired software contracts that were not executed-and for which "evidence of an arrangement" did not exist-until a subsequent quarter. This extended quarters practice resulted in CA's premature recognition of revenue. As a consequence, CA made material misrepresentations and omissions of fact concerning CA's revenues and earnings for the fourth quarter of FY1998 through the second quarter of FY2001 in various public documents and in connection with the offer, purchase, and sale of securities. CA's reported results for at least the fourth quarter of FY1998 through the fourth quarter of FY2000 appeared to meet or exceed the revenue and earnings estimates of outside analysts when, in fact, those reported results did not comply with GAAP and were false and misleading.

In its Form 8-K, which was not an audited restatement, CA admits that the extended quarters practice resulted in CA prematurely recognizing substantial percentages of revenue for all quarters of FY2000 and the first two quarters of FY2001. The following chart illustrates the impact of the premature revenue recognition in each fiscal quarter:

The greatest amount of prematurely recognized revenue as a result of the extended quarters practice occurred in FY2000, particularly in the third quarter, followed by the second, fourth and first quarters of that fiscal year. If CA had not improperly recognized revenue in each of those fiscal quarters, CA would not have met analysts' revenue and earnings estimates.

The following is a chart which shows the impact of the extended quarters practice on CA's earnings per share in the four quarters of FY2000 and the extent of the material misstatements and misrepresentations in the Forms 10-Q and Form 10-K that CA filed with the SEC which reported each quarterly result, and related public statements made by CA:

A Systemic and Intentional Practice

The premature recognition of revenue at CA during at least the fourth quarter of FY1998 through the second quarter of FY2001 was the result of a systemic, intentional practice by certain CA personnel. To implement and conceal this extended quarters practice, CA personnel employed a variety of improper techniques, many of which rendered the company's books and records false and misleading, including:

• Some employees at CA called the extended quarters practice the "35-day month" practice, because generally most quarters were extended by at least 3 business days, although some quarterly extensions lasted longer.

• Sometimes CA had its customers execute contracts bearing preprinted dates from the just-expired quarter, even though the customer did not actually sign the contract until days or weeks into the new quarter.

CA substantially stopped prematurely recognizing revenue for software contracts signed after quarter end by CA's customers during the first quarter of FY2001 (quarter ended June 30, 2000). That quarter, CA missed its Wall Street earnings estimates. CA issued a press release on July 3, 2000, stating that it would miss the analysts' estimates, specifically citing the fact that the company did not complete several large contracts that they had hoped to conclude before the close of the quarter. This was only the second time in CA's then-recent history that CA missed Wall Street's estimates. The next trading day, July 5, 2000, CA's share price dropped over 43 percent, from $51.12 to $28.50, as the market reacted to the news. The share price has not recovered and closed at $26.26 on June 14, 2013.

CA continued to recognize revenue prematurely from contracts that CA signed after quarter end (although, with a few exceptions, the customer did sign the contract by quarter end) for the first two quarters of FY2001, after which that practice substantially stopped.

Legal Matters Resolved

In September 2004, CA agreed to pay $225 million in restitution to shareholders to settle the civil case brought by the SEC and to defer criminal charges by the U.S. Department of Justice. At the same time, a federal grand jury brought criminal charges against former CA chairman and CEO Sanjay Kumar. Kumar resigned in April 2004 following an investigation into securities fraud and obstruction of justice at CA. A federal grand jury in Brooklyn indicted him on fraud charges on September 22, 2004. Kumar pled guilty to obstruction of justice and securities fraud charges on April 24, 2006. On November 2, 2006, he was sentenced to 12 years in prison and fined $8 million for his role in the massive accounting fraud at CA. Kumar is currently housed at the Federal Correctional Institution in Miami, Florida, with a projected release date of January 25, 2018.

Questions

1. Analyze each revenue recognition technique identified in the audit committee investigation and explain whether each technique violates revenue recognition rules in accounting. Evaluate the practices followed by CA from an ethical perspective.

2. CA executives were not accused of reporting nonexistent deals or hiding major flaws in the business. The contracts that were backdated by a few days were real. Was this really a crime, or should it fall under the heading of "no harm, no foul"? Be sure to use ethical reasoning in responding to the question.

3. In her "Seven Signs of Ethical Collapse," which were discussed in Chapter 3, Marianne Jennings listed "pressure to maintain the numbers" as the number one sign. How can a company like CA resist such pressure?

1 The material in this case is taken from the SEC complaint against CA that can be found at http://www.sec.gov/litigation/complaints/comp18891-cai.pdf.

2 SOPs are pronouncements on specific accounting matters that had been issued by the AICPA's Accounting Standards Division from 1974 to 2009. The FASB GAAP Codification of authoritative accounting standards issued in 2009 supersedes existing sources of US GAAP including Statements of Position.

Explanation

1. Accrual earnings are income that has ...

Ethical Obligations and Decision-Making in Accounting: Text and Cases 3rd Edition by Steven Mintz,Roselyn Morris

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255