Excel Applications for Accounting Principles 4th Edition by Gaylord Smith

Edition 4ISBN: 978-1111581565

Excel Applications for Accounting Principles 4th Edition by Gaylord Smith

Edition 4ISBN: 978-1111581565 Exercise 1

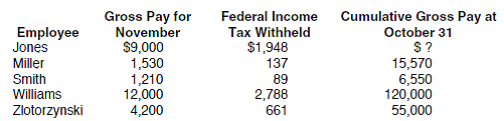

PROBLEM DATA

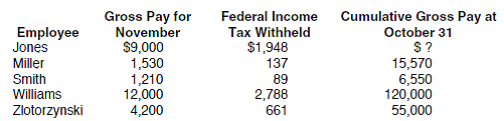

Reno Graphics has five employees, and they are paid at the end of each month. Payroll data for November are as follows:

Other information (using 2011 rates) is as follows:

a. Social security taxes are 4.2% of monthly gross pay up to a cumulative total pay of $106,800 for 2011. Employers must pay 6.2% of monthly gross pay up to a cumulative total pay of $106,800 for each employee.

b. Medicare taxes are 1.45% on monthly gross pay with no upper limit.

c. A $25 monthly deduction is made for union dues for all union members.

d. Unemployment taxes are paid on monthly gross pay up to the first $7,000 earned by each employee each year. State and federal rates are 2.7% and.8%, respectively.

REQUIREMENT

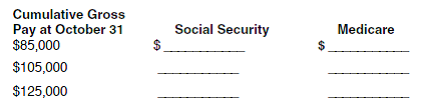

Based on 2011 tax rates provided, use a calculator to compute how much would be withheld from Jones's November paycheck in the following three cases (round to the nearest penny):

Reno Graphics has five employees, and they are paid at the end of each month. Payroll data for November are as follows:

Other information (using 2011 rates) is as follows:

a. Social security taxes are 4.2% of monthly gross pay up to a cumulative total pay of $106,800 for 2011. Employers must pay 6.2% of monthly gross pay up to a cumulative total pay of $106,800 for each employee.

b. Medicare taxes are 1.45% on monthly gross pay with no upper limit.

c. A $25 monthly deduction is made for union dues for all union members.

d. Unemployment taxes are paid on monthly gross pay up to the first $7,000 earned by each employee each year. State and federal rates are 2.7% and.8%, respectively.

REQUIREMENT

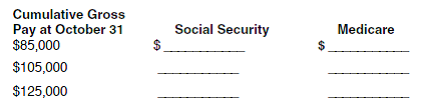

Based on 2011 tax rates provided, use a calculator to compute how much would be withheld from Jones's November paycheck in the following three cases (round to the nearest penny):

Explanation

Social Security Tax and Medi-Care Tax:

...

Excel Applications for Accounting Principles 4th Edition by Gaylord Smith

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255