Introduction to Management Science 12th Edition by Bernard Taylor

Edition 12ISBN: 978-0133778847

Introduction to Management Science 12th Edition by Bernard Taylor

Edition 12ISBN: 978-0133778847 Exercise 67

The Place-Plus real estate development firm in Problem is dissatisfied with the economist's estimate of the probabilities of future interest rate movement, so it is considering having a financial consulting firm provide a report on future interest rates. The consulting firm is able to cite a track record, which shows that 80% of the time when interest rates declined, it had predicted they would, whereas 10% of the time when interest rates declined, the firm had predicted they would remain stable and 10% of the time it had predicted they would increase. The firm has been correct 70% of the time when rates have remained stable, whereas 10% of the time it has incorrectly predicted that rates would decrease, and 20% of the time it has incorrectly predicted that rates would increase. The firm has correctly predicted that interest rates would increase 90% of the time and incorrectly predicted rates would decrease 2% and remain stable 8% of the time. Assuming that the consulting firm could supply an accurate report, determine how much Place- Plus should be willing to pay the consulting firm and how efficient the information will be.

Problem

In Problem, the Place-Plus real estate development firm has hired an economist to assign a probability to each direction interest rates may take over the next 5 years. The economist has determined that there is a.50 probability that interest rates will decline, a.40 probability that rates will remain stable, and a.10 probability that rates will increase.

a. Using expected value, determine the best project.

b. Determine the expected value of perfect information.

Problem

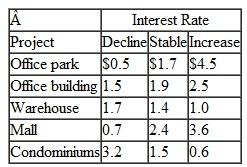

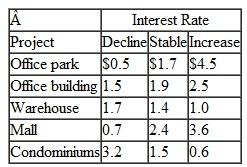

Place-Plus, a real estate development firm, is considering several alternative development projects. These include building and leasing an office park, purchasing a parcel of land and building an office building to rent, buying and leasing a warehouse, building a strip mall, and building and selling condominiums. The financial success of these projects depends on interest rate movement in the next 5 years. The various development projects and their 5-year financial return (in $1,000,000s), given that interest rates will decline, remain stable, or increase, are shown in the following payoff table:

Determine the best investment, using the following decision criteria.

Determine the best investment, using the following decision criteria.

a. Maximax

b. Maximin

c. Equal likelihood

d. Hurwicz ( =.3)

Problem

In Problem, the Place-Plus real estate development firm has hired an economist to assign a probability to each direction interest rates may take over the next 5 years. The economist has determined that there is a.50 probability that interest rates will decline, a.40 probability that rates will remain stable, and a.10 probability that rates will increase.

a. Using expected value, determine the best project.

b. Determine the expected value of perfect information.

Problem

Place-Plus, a real estate development firm, is considering several alternative development projects. These include building and leasing an office park, purchasing a parcel of land and building an office building to rent, buying and leasing a warehouse, building a strip mall, and building and selling condominiums. The financial success of these projects depends on interest rate movement in the next 5 years. The various development projects and their 5-year financial return (in $1,000,000s), given that interest rates will decline, remain stable, or increase, are shown in the following payoff table:

Determine the best investment, using the following decision criteria.

Determine the best investment, using the following decision criteria.a. Maximax

b. Maximin

c. Equal likelihood

d. Hurwicz ( =.3)

Explanation

The expected value of perfect informatio...

Introduction to Management Science 12th Edition by Bernard Taylor

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255