Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Edition 3ISBN: 978-0073377322

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Edition 3ISBN: 978-0073377322 Exercise 22

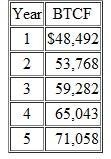

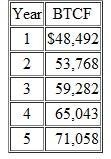

You are considering the acquisition of small office building. The purchase price is $775,000. Seventy-five percent of the purchase price can be borrowed with a 30-year, 7.5 percent mortgage. Payments will be made annually. Up-front financing costs will total 3 percent of the loan amount. The expected before-tax cash flows from operations, assuming a five-year holding period, are as follows:

The before-tax cash flow from the sale of the property is expected to be $295,050. What is the net present value of this investment, assuming a 12 percent required rate of return on levered cash flows What is the levered internal rate of return

The before-tax cash flow from the sale of the property is expected to be $295,050. What is the net present value of this investment, assuming a 12 percent required rate of return on levered cash flows What is the levered internal rate of return

The before-tax cash flow from the sale of the property is expected to be $295,050. What is the net present value of this investment, assuming a 12 percent required rate of return on levered cash flows What is the levered internal rate of return

The before-tax cash flow from the sale of the property is expected to be $295,050. What is the net present value of this investment, assuming a 12 percent required rate of return on levered cash flows What is the levered internal rate of returnExplanation

We are asked to use the following inform...

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255