Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Edition 3ISBN: 978-0073377322

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Edition 3ISBN: 978-0073377322 Exercise 23

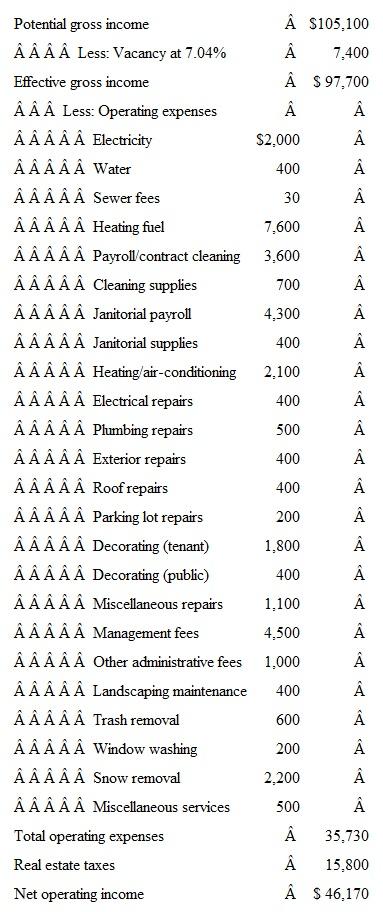

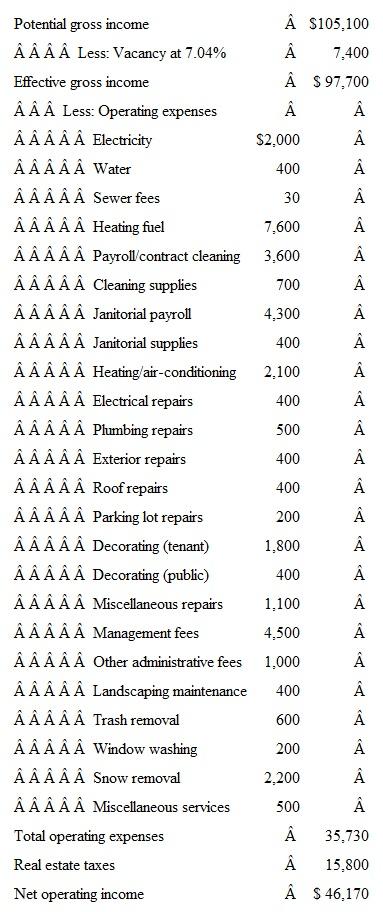

Table 1 Reconstructed Income and Expense Statement for Question 15

The property to be analyzed is a two-story, multitenant office building containing 10,000 square feet of rentable space. The building is situated on a 25,000-square-foot site that is partially landscaped and contains 35 parking spaces. The property is being offered for $500,000. The investor's ordinary and capital gain tax rates are 28 and 15 percent, respectively.

The property to be analyzed is a two-story, multitenant office building containing 10,000 square feet of rentable space. The building is situated on a 25,000-square-foot site that is partially landscaped and contains 35 parking spaces. The property is being offered for $500,000. The investor's ordinary and capital gain tax rates are 28 and 15 percent, respectively.

Multitenant office buildings are sometimes leased on a gross rental basis. In this case, the property owner pays all operating expenses. Income from the building is $10.51 per square foot of rentable area, for a total of $105,100 per year before vacancy losses. Office buildings in the area experience a vacancy rate of 7 percent, on average, of potential gross income.

Table 1 contains income and expense information for the property (first year pro forma). Expenses were estimated after studying the building's operating history and that of comparable buildings in the area.

A loan of $375,000 is available at 8 percent interest with a 30-year amortization schedule and annual payments.

The investor will use the straight-line depreciation method over a 39-year period. The expected purchase price of $500,000 is allocated 85 percent to building and 15 percent to the land (no personal property). This allocation is supported by the local tax assessor's records.

Rental income is expected to grow by 8 percent per year. Operating expenses are expected to grow by 4 percent per year. The terminal capitalization rate of 10 percent is applied to expected net operating income in year 3 to determine the future sales price at the end of in year 2. Selling expenses are 7 percent of the sale price. All passive activity losses ( PAL ) from the investment will be used to shelter income from passive income generators ( PIG s), of which the investor has a "barn full." Assuming a two-year holding period, should the investor make this investment given a required levered, after-tax rate of return of 14 percent Defend your answer with quantitative evidence from the analysis you perform.

The property to be analyzed is a two-story, multitenant office building containing 10,000 square feet of rentable space. The building is situated on a 25,000-square-foot site that is partially landscaped and contains 35 parking spaces. The property is being offered for $500,000. The investor's ordinary and capital gain tax rates are 28 and 15 percent, respectively.

The property to be analyzed is a two-story, multitenant office building containing 10,000 square feet of rentable space. The building is situated on a 25,000-square-foot site that is partially landscaped and contains 35 parking spaces. The property is being offered for $500,000. The investor's ordinary and capital gain tax rates are 28 and 15 percent, respectively.Multitenant office buildings are sometimes leased on a gross rental basis. In this case, the property owner pays all operating expenses. Income from the building is $10.51 per square foot of rentable area, for a total of $105,100 per year before vacancy losses. Office buildings in the area experience a vacancy rate of 7 percent, on average, of potential gross income.

Table 1 contains income and expense information for the property (first year pro forma). Expenses were estimated after studying the building's operating history and that of comparable buildings in the area.

A loan of $375,000 is available at 8 percent interest with a 30-year amortization schedule and annual payments.

The investor will use the straight-line depreciation method over a 39-year period. The expected purchase price of $500,000 is allocated 85 percent to building and 15 percent to the land (no personal property). This allocation is supported by the local tax assessor's records.

Rental income is expected to grow by 8 percent per year. Operating expenses are expected to grow by 4 percent per year. The terminal capitalization rate of 10 percent is applied to expected net operating income in year 3 to determine the future sales price at the end of in year 2. Selling expenses are 7 percent of the sale price. All passive activity losses ( PAL ) from the investment will be used to shelter income from passive income generators ( PIG s), of which the investor has a "barn full." Assuming a two-year holding period, should the investor make this investment given a required levered, after-tax rate of return of 14 percent Defend your answer with quantitative evidence from the analysis you perform.

Explanation

The after- tax cash flows are calculated...

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255