PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

Edition 3ISBN: 978-1285082578

PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

Edition 3ISBN: 978-1285082578 Exercise 6

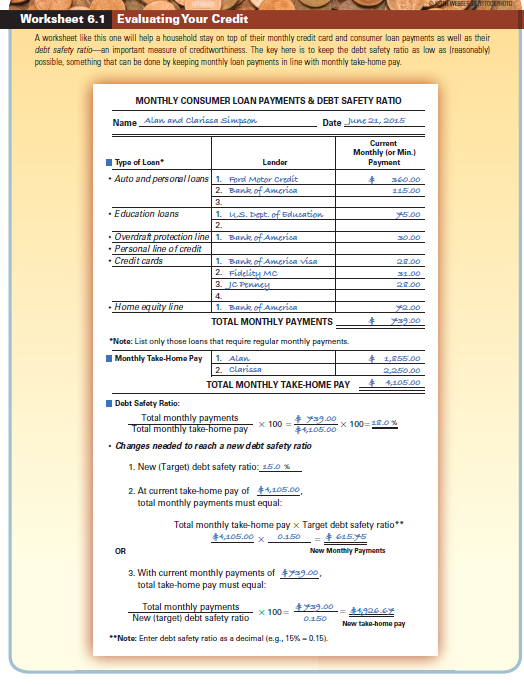

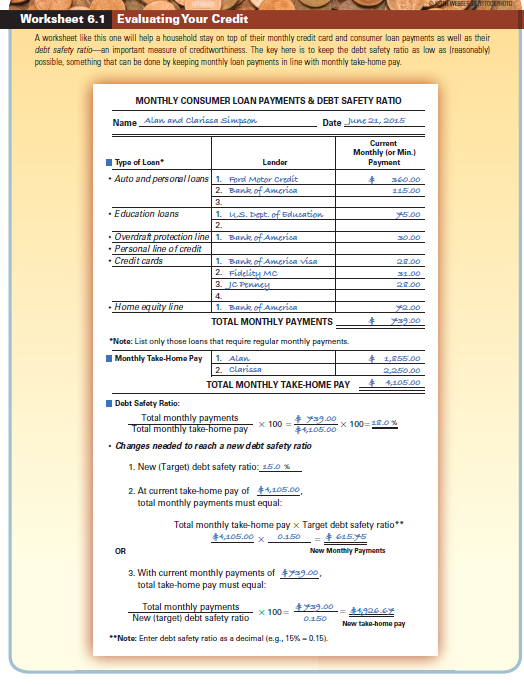

Use Worksheet 6.1. Rebecca Collins is evaluating her debt safety ratio. Her monthly takehome pay is $3,320. Each month, she pays $380 for an auto loan, $120 on a personal line of credit, $60 on a department store charge card, and $85 on her bank credit card. Complete Worksheet 6.1 by listing Rebecca's outstanding debts, and then calculate her debt safety ratio. Given her current take-home pay, what is the maximum amount of monthly debt payments that Rebecca can have if she wants her debt safety ratio to be 12.5 percent? Given her current monthly debt payment load, what would Rebecca's take-home pay have to be if she wanted a 12.5 percent debt safety ratio?

Explanation

Debt safety ratio is a ratio (or) propor...

PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255