Detecting Accounting Fraud 1st Edition by Cecil Jackson

Edition 1ISBN: 978-0133078602

Detecting Accounting Fraud 1st Edition by Cecil Jackson

Edition 1ISBN: 978-0133078602 Exercise 38

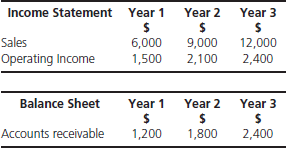

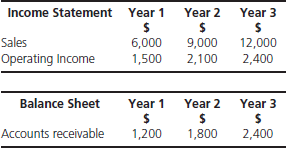

Examine the following extracts from Blake Co.'s income statement and balance sheet for the previous three years.

You also read in the financial press that Blake Co. sold $2,000 of its accounts receivable in year 3.

Required

a. Calculate the ratio of accounts receivable as a percentage of sales for years 1, 2, and 3 without taking into account what you read about the sale of Blake's accounts receivable.

b. Calculate the ratio of accounts receivable as a percentage of sales for years 1, 2, and 3 after adjusting for the sale of Blake's accounts receivable.

You also read in the financial press that Blake Co. sold $2,000 of its accounts receivable in year 3.

Required

a. Calculate the ratio of accounts receivable as a percentage of sales for years 1, 2, and 3 without taking into account what you read about the sale of Blake's accounts receivable.

b. Calculate the ratio of accounts receivable as a percentage of sales for years 1, 2, and 3 after adjusting for the sale of Blake's accounts receivable.

Explanation

Ratio Analysis

Ratio analysis refers to...

Detecting Accounting Fraud 1st Edition by Cecil Jackson

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255