College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Edition 2ISBN: 978-0073396958

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Edition 2ISBN: 978-0073396958 Exercise 1

Recording sales, sales returns, and cash receipts for a retail store.

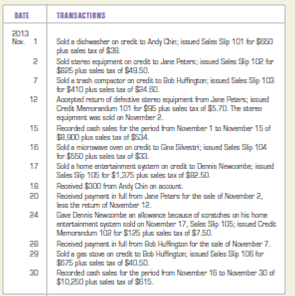

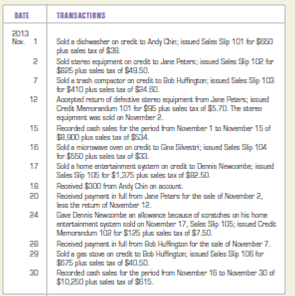

The Appliance Discounter began operations November 1, 2013. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During November, The Appliance Discounter engaged in the following transactions:

INSTRUCTIONS

Record the transactions in a general journal. Use 1 as the journal page number.

Analyze: What is the total amount due from Bob Huffington for the November 29 sale?

The Appliance Discounter began operations November 1, 2013. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During November, The Appliance Discounter engaged in the following transactions:

INSTRUCTIONS

Record the transactions in a general journal. Use 1 as the journal page number.

Analyze: What is the total amount due from Bob Huffington for the November 29 sale?

Explanation

Recording sale made on account with a sa...

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255