College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Edition 2ISBN: 978-0073396958

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Edition 2ISBN: 978-0073396958 Exercise 44

Computing employer's social security tax, Medicare tax, and unemployment taxes.

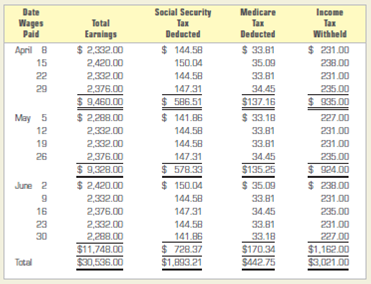

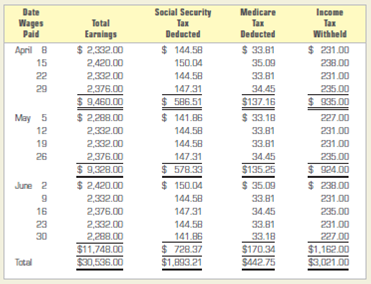

A payroll summary for Fronke Consulting Company, owned by Mark Fronke, for the quarter ending June 30, 2013, appears on page 362. The firm prepared the required tax deposit forms and issued checks as follows:

a. Federal Tax Deposit Coupon, Form 8109, check for April taxes, paid on May 15.

b. Federal Tax Deposit Coupon, Form 8109, check for May taxes, paid on June 17.

INSTRUCTIONS

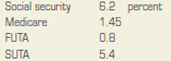

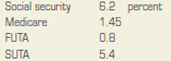

1. Using the tax rates given below, and assuming that all earnings are taxable, make the general journal entry on April 8, 2013, to record the employer's payroll tax expense on the payroll ending that date. Use journal page 12.

2. Prepare the entries in general journal form to record deposit of the employee income tax withheld and the social security and Medicare taxes (employee and employer shares) on May 15 for April taxes and on June 17 for May taxes.

Analyze: How were the amounts for Income Tax Withheld determined?

A payroll summary for Fronke Consulting Company, owned by Mark Fronke, for the quarter ending June 30, 2013, appears on page 362. The firm prepared the required tax deposit forms and issued checks as follows:

a. Federal Tax Deposit Coupon, Form 8109, check for April taxes, paid on May 15.

b. Federal Tax Deposit Coupon, Form 8109, check for May taxes, paid on June 17.

INSTRUCTIONS

1. Using the tax rates given below, and assuming that all earnings are taxable, make the general journal entry on April 8, 2013, to record the employer's payroll tax expense on the payroll ending that date. Use journal page 12.

2. Prepare the entries in general journal form to record deposit of the employee income tax withheld and the social security and Medicare taxes (employee and employer shares) on May 15 for April taxes and on June 17 for May taxes.

Analyze: How were the amounts for Income Tax Withheld determined?

Explanation

Make the general journal entry to record...

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255