Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 9

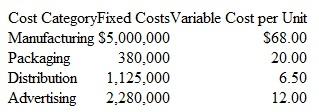

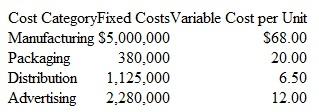

Life-Cycle Costing, Health Care, Present Values Cure-all, Inc., has developed a drug that will diminish the effects of aging. Cure-all has spent $1,000,000 on research and development and $2,108,000 for clinical trials. Once the drug is approved by the FDA, which is imminent, it will have a five-year sales life cycle. Laura Russell, Cure-all's chief financial officer, must determine the best alternative for the company among three options. The company can choose tomanufacture, package, and distribute the drug; outsource only the manufacturing; or sell the drug's patent. Laura has compiled the following annual cost information for this drug if the company were to manufacture it:

Management anticipates a high demand for the drug and has benchmarked $235 per unit as a reasonable price based on other drugs that promise similar results. Management expects sales volume of 3,000,000 units over five years and uses a discount rate of 10 percent.

Management anticipates a high demand for the drug and has benchmarked $235 per unit as a reasonable price based on other drugs that promise similar results. Management expects sales volume of 3,000,000 units over five years and uses a discount rate of 10 percent.

If Cure-all chooses to outsource the manufacturing of the drug while continuing to package, distribute, and advertise it, the manufacturing costs would result in fixed costs of $1,500,000 and variable cost per unit of $80. For the sale of the patent, Cure-all would receive $300,000,000 now and $25,000,000 at the end of every year for the next five years.

Required Determine the best option for Cure-all. Support your answer.

Management anticipates a high demand for the drug and has benchmarked $235 per unit as a reasonable price based on other drugs that promise similar results. Management expects sales volume of 3,000,000 units over five years and uses a discount rate of 10 percent.

Management anticipates a high demand for the drug and has benchmarked $235 per unit as a reasonable price based on other drugs that promise similar results. Management expects sales volume of 3,000,000 units over five years and uses a discount rate of 10 percent.If Cure-all chooses to outsource the manufacturing of the drug while continuing to package, distribute, and advertise it, the manufacturing costs would result in fixed costs of $1,500,000 and variable cost per unit of $80. For the sale of the patent, Cure-all would receive $300,000,000 now and $25,000,000 at the end of every year for the next five years.

Required Determine the best option for Cure-all. Support your answer.

Explanation

If Cure-all were to manufacture the drug...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255