Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 51

Journal Entries for Factory Overhead Costs and Standard Cost Variances; Spreadsheet Application

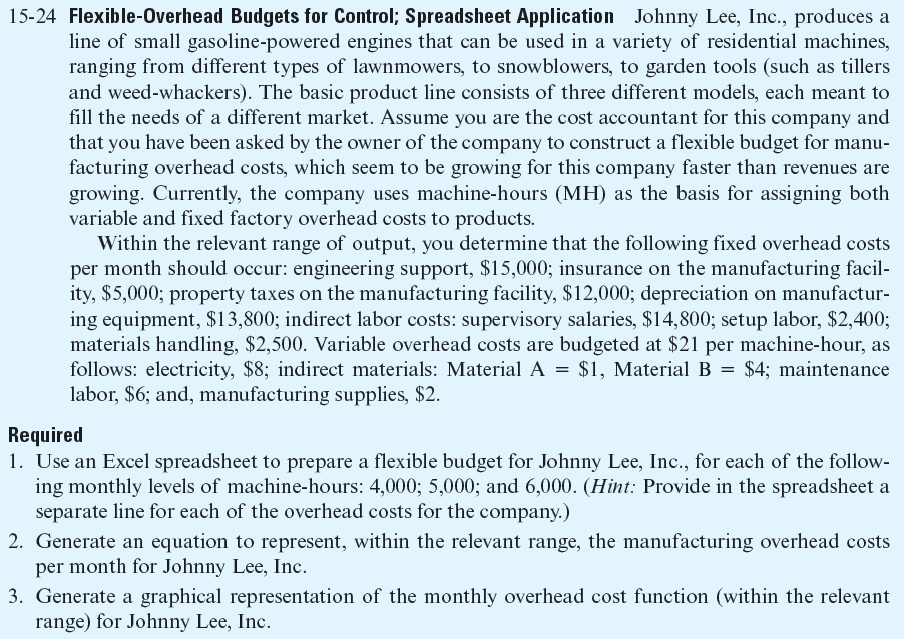

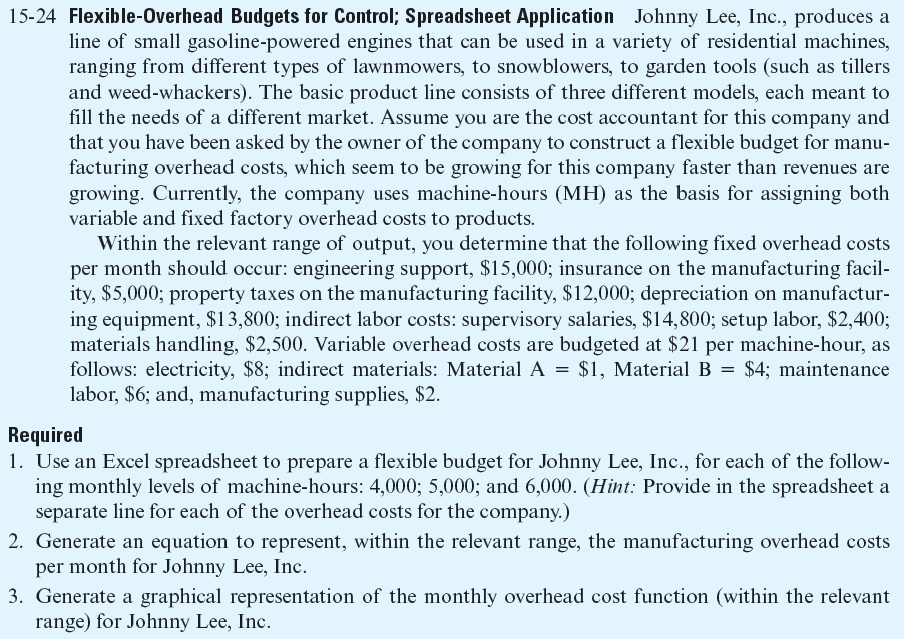

Refer to the information for Johnny Lee, Inc., in Exercise 15-24. Assume that in a given month the standard allowed machine-hours for output produced were 5,500. Also, assume that the denominator activity level for setting the predetermined overhead rate is 6,550 machine-hours per month.

Actual fixed overhead costs for the month were as follows: engineering support, $15,500 (salaries); factory insurance, $5,500; property taxes, $12,000; equipment depreciation, $13,800; supervisory salaries, $14,800; setup labor, $2,200; materials-handling labor, $2,400. The actual variable overhead cost per machine-hour worked was equal to the standard cost except for the following two items: electricity, $8.50 per machine-hour; manufacturing supplies, $2.10 per machine-hour. The company used 5,600 machine-hours in December.

The company uses a single overhead account, Factory Overhead, and performs a two-way analysis of the total overhead cost variance each month.

Required

1. Calculate the (a) flexible-budget variance, and (b) the fixed overhead production volume variance for the month. ( Hint: The total overhead variance for the month is $16,660U.)

2. Provide summary journal entries to record actual overhead costs and standard overhead cost applied to production during the month.

3. Provide the journal entry to record the two overhead cost variances for the month.

4. Assume that the variances calculated above represent net variances for the year. Give the required journal entry to close these variances to the Cost of Goods Sold (CGS) account.

Reference:

Refer to the information for Johnny Lee, Inc., in Exercise 15-24. Assume that in a given month the standard allowed machine-hours for output produced were 5,500. Also, assume that the denominator activity level for setting the predetermined overhead rate is 6,550 machine-hours per month.

Actual fixed overhead costs for the month were as follows: engineering support, $15,500 (salaries); factory insurance, $5,500; property taxes, $12,000; equipment depreciation, $13,800; supervisory salaries, $14,800; setup labor, $2,200; materials-handling labor, $2,400. The actual variable overhead cost per machine-hour worked was equal to the standard cost except for the following two items: electricity, $8.50 per machine-hour; manufacturing supplies, $2.10 per machine-hour. The company used 5,600 machine-hours in December.

The company uses a single overhead account, Factory Overhead, and performs a two-way analysis of the total overhead cost variance each month.

Required

1. Calculate the (a) flexible-budget variance, and (b) the fixed overhead production volume variance for the month. ( Hint: The total overhead variance for the month is $16,660U.)

2. Provide summary journal entries to record actual overhead costs and standard overhead cost applied to production during the month.

3. Provide the journal entry to record the two overhead cost variances for the month.

4. Assume that the variances calculated above represent net variances for the year. Give the required journal entry to close these variances to the Cost of Goods Sold (CGS) account.

Reference:

Explanation

Variances:

Variance is the difference b...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255