Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314 Exercise 19

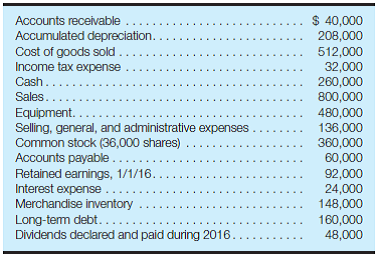

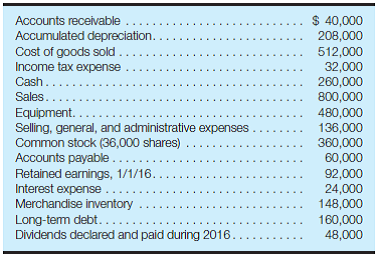

Prepare an income statement, balance sheet, and statement of changes in stockholders' equity; analyze results The information on the following page was obtained from the records of Breanna, Inc.:

Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2016, and that all income statement items reflect activities that occurred during the year ended December 31, 2016. There were no changes in paid-in capital during the year.

Required:

a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2016, and a balance sheet at December 31, 2016, for Breanna, Inc.

Based on the financial statements that you have prepared for part a , answer the questions in parts b-e. Provide brief explanations for each of your answers and state any assumptions you believe are necessary to ensure that your answers are correct.

b. What is the company's average income tax rate?

c. What interest rate is charged on long-term debt?

d. What is the par value per share of common stock?

e. What is the company's dividend policy (i.e., what proportion of the company's earnings are used for dividends)?

Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2016, and that all income statement items reflect activities that occurred during the year ended December 31, 2016. There were no changes in paid-in capital during the year.

Required:

a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2016, and a balance sheet at December 31, 2016, for Breanna, Inc.

Based on the financial statements that you have prepared for part a , answer the questions in parts b-e. Provide brief explanations for each of your answers and state any assumptions you believe are necessary to ensure that your answers are correct.

b. What is the company's average income tax rate?

c. What interest rate is charged on long-term debt?

d. What is the par value per share of common stock?

e. What is the company's dividend policy (i.e., what proportion of the company's earnings are used for dividends)?

Explanation

Preparation financial statement-analyse ...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255