Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314 Exercise 25

Record transactions and adjustments The transactions and adjustments related to the second month of operations of Zoe Amelia Corp. were as follows:

a. Paid wages that had been accrued at the end of the prior month.

b. Collected accounts receivable from sales recorded in the prior month.

c. Paid accounts payable owed for purchases made in the prior month.

d. Borrowed cash from a local bank on a short-term promissory note.

e. Purchased merchandise inventory for cash.

f. Incurred and paid utilities expense for the month.

g. At the end of the month, accrued interest on the short-term promissory note recorded in transaction d.

h. Recognized rent expense for one month of the three-month payment of rent in advance made in the prior month (as a reclassification adjusting entry).

Required:

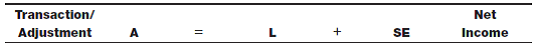

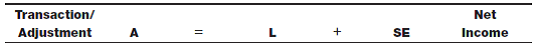

Enter the following column headings across the top of a sheet of paper:

Enter the transaction/adjustment in the first column, and show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on net income by indicating the account name(s) affected and whether each is an addition (+) or subtraction (?). Items that affect net income should not be shown as affecting stockholders' equity.

a. Paid wages that had been accrued at the end of the prior month.

b. Collected accounts receivable from sales recorded in the prior month.

c. Paid accounts payable owed for purchases made in the prior month.

d. Borrowed cash from a local bank on a short-term promissory note.

e. Purchased merchandise inventory for cash.

f. Incurred and paid utilities expense for the month.

g. At the end of the month, accrued interest on the short-term promissory note recorded in transaction d.

h. Recognized rent expense for one month of the three-month payment of rent in advance made in the prior month (as a reclassification adjusting entry).

Required:

Enter the following column headings across the top of a sheet of paper:

Enter the transaction/adjustment in the first column, and show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on net income by indicating the account name(s) affected and whether each is an addition (+) or subtraction (?). Items that affect net income should not be shown as affecting stockholders' equity.

Explanation

The given transactions are recorded in t...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255