Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314 Exercise 14

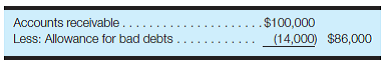

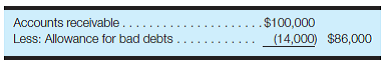

Analysis of accounts receivable and allowance for bad debts-determine beginning balances A portion of the current assets section of the December 31, 2017, balance sheet for Carr Co. is presented here:

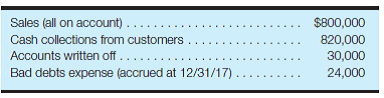

The company's accounting records revealed the following information for the year ended December 31, 2017:

Required:

Using the information provided for 2017, calculate the net realizable value of accounts receivable at December 31, 2016, and prepare the appropriate balance sheet presentation for Carr Co., as of that point in time. (Hint: Use T-accounts to analyze the Accounts Receivable and Allowance for Bad Debts accounts. Remember that you are solving for the beginning balance of each account.)

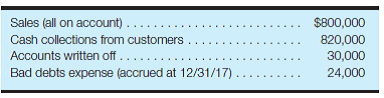

The company's accounting records revealed the following information for the year ended December 31, 2017:

Required:

Using the information provided for 2017, calculate the net realizable value of accounts receivable at December 31, 2016, and prepare the appropriate balance sheet presentation for Carr Co., as of that point in time. (Hint: Use T-accounts to analyze the Accounts Receivable and Allowance for Bad Debts accounts. Remember that you are solving for the beginning balance of each account.)

Explanation

Calculate the net realizable value of ac...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255