Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314 Exercise 33

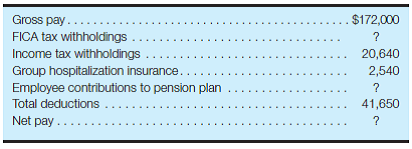

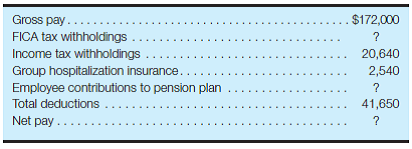

Other accrued liabilities-payroll and payroll taxes The following summary data for the payroll period ended December 27, 2015, are available for Cayman Coating Co.:

Additional information

• For employees, FICA tax rates for 2015 were 7.65% on the first $118,500 of each employee's annual earnings. However, no employees had accumulated earnings for the year in excess of the $118,500 limit.

• For employers, FICA tax rates for 2015 were also 7.65% on the first $118,500 of each employee's annual earnings.

• The federal and state unemployment compensation tax rates are 0.6% and 5.4%, respectively. These rates are levied against the employer for the first $7,000 of each employee's annual earnings. Only $18,000 of the gross pay amount for the December 27, 2015, pay period was owed to employees who were still under the annual limit.

Required:

Assuming that Cayman Coating Co.'s payroll for the last week of the year is to be paid on January 3, 2016, use the horizontal model (or write the journal entry) to record the effects of the December 27, 2015, entries for

a. Accrued payroll.

b. Accrued payroll taxes.

Additional information

• For employees, FICA tax rates for 2015 were 7.65% on the first $118,500 of each employee's annual earnings. However, no employees had accumulated earnings for the year in excess of the $118,500 limit.

• For employers, FICA tax rates for 2015 were also 7.65% on the first $118,500 of each employee's annual earnings.

• The federal and state unemployment compensation tax rates are 0.6% and 5.4%, respectively. These rates are levied against the employer for the first $7,000 of each employee's annual earnings. Only $18,000 of the gross pay amount for the December 27, 2015, pay period was owed to employees who were still under the annual limit.

Required:

Assuming that Cayman Coating Co.'s payroll for the last week of the year is to be paid on January 3, 2016, use the horizontal model (or write the journal entry) to record the effects of the December 27, 2015, entries for

a. Accrued payroll.

b. Accrued payroll taxes.

Explanation

(a)To record the journal entry for accru...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255