Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314 Exercise 4

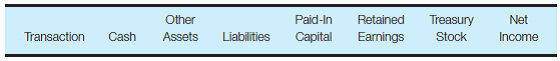

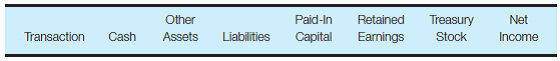

Transaction analysis-various accounts Enter the following column headings across the top of a sheet of paper:

Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or minus (?) sign and the amount in the appropriate column. Do not show items that affect net income in the retained earnings column. You may also write the entries to record these transactions. You should assume that the transactions occurred in the same chronological sequence as listed here:

a. Sold 2,700 shares of $50 par value preferred stock at $53.50 per share.

b. Declared the annual cash dividend of $3.70 per share on common stock. There were 7,300 shares of $1 par value common stock issued and outstanding throughout the year.

c. Issued 5,000 shares of $50 par value preferred stock in exchange for a building when the market price of preferred stock was $53 per share.

d. Purchased 1,400 shares of preferred stock for the treasury at a price of $56 per share.

e. Sold 500 shares of the preferred stock held in treasury (see d ) for $57 per share.

f. Declared and issued a 15% stock dividend on the $1 par value common stock when the market price per share was $36.

Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or minus (?) sign and the amount in the appropriate column. Do not show items that affect net income in the retained earnings column. You may also write the entries to record these transactions. You should assume that the transactions occurred in the same chronological sequence as listed here:

a. Sold 2,700 shares of $50 par value preferred stock at $53.50 per share.

b. Declared the annual cash dividend of $3.70 per share on common stock. There were 7,300 shares of $1 par value common stock issued and outstanding throughout the year.

c. Issued 5,000 shares of $50 par value preferred stock in exchange for a building when the market price of preferred stock was $53 per share.

d. Purchased 1,400 shares of preferred stock for the treasury at a price of $56 per share.

e. Sold 500 shares of the preferred stock held in treasury (see d ) for $57 per share.

f. Declared and issued a 15% stock dividend on the $1 par value common stock when the market price per share was $36.

Explanation

Each of the following transact...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255