Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 18

Extensions of the CVP Basic Model-Multiple Products

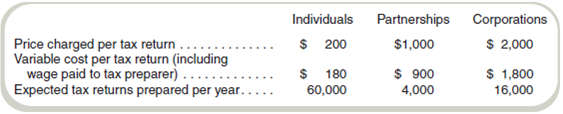

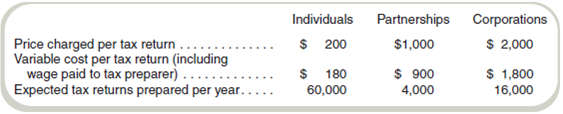

Sell Block prepares three types of simple tax returns: individual, partnerships, and (small) corporations. The tax returns have the following characteristics:

The total fixed costs per year for the company are $3,690,000.

Required

a. What is the anticipated level of profits for the expected sales volumes

b. Assuming that the product mix is the same at the break-even point, compute the break-even point.

c. Suppose the product sales mix changes so that, for every ten tax returns prepared, six are for individuals, one is for a partnership, and three are for corporations. Now what is the breakeven volume for Sell Block

Sell Block prepares three types of simple tax returns: individual, partnerships, and (small) corporations. The tax returns have the following characteristics:

The total fixed costs per year for the company are $3,690,000.

Required

a. What is the anticipated level of profits for the expected sales volumes

b. Assuming that the product mix is the same at the break-even point, compute the break-even point.

c. Suppose the product sales mix changes so that, for every ten tax returns prepared, six are for individuals, one is for a partnership, and three are for corporations. Now what is the breakeven volume for Sell Block

Explanation

a.

Calculate the anticipated level of pr...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255