Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 21

Extensions of the CVP Basic Model-Multiple Products and Taxes

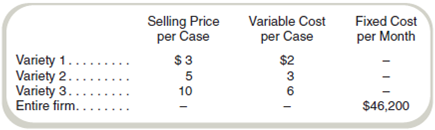

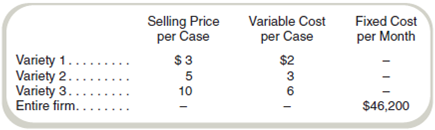

Assume that Ocean King Products sells three varieties of canned seafood with the following prices and costs:

The sales mix (in cases) is 40 percent Variety 1, 35 percent Variety 2, and 25 percent Variety 3.

Required

a. At what sales revenue per month does the company break even

b. Suppose the company is subject to a 35 percent tax rate on income. At what sales revenue per month will the company earn $40,950 after taxes assuming the same sales mix

Assume that Ocean King Products sells three varieties of canned seafood with the following prices and costs:

The sales mix (in cases) is 40 percent Variety 1, 35 percent Variety 2, and 25 percent Variety 3.

Required

a. At what sales revenue per month does the company break even

b. Suppose the company is subject to a 35 percent tax rate on income. At what sales revenue per month will the company earn $40,950 after taxes assuming the same sales mix

Explanation

a.

Calculate break-even point

Break-ev...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255