Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 24

Assigning Costs to Jobs

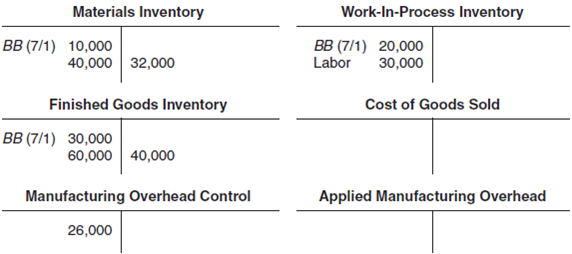

Partially completed T-accounts and additional information for Tigers, Inc., for the month of July follow.

Additional information for July follows:

•Labor wage rate was $30 per hour.

•Manufacturing overhead is applied at $24 per direct labor-hour.

•During the month, sales revenue was $90,000, and selling and administrative costs were $16,000.

•This company has no indirect materials or supplies.

Required

a. What cost amount of direct materials was issued to production during July

b. How much manufacturing overhead was applied to products during July

c. What was the cost of products completed during July

d. What was the balance of the Work-in-Process Inventory account at the end of July

e. What was the over- or underapplied manufacturing overhead for July

f. What was the operating profit for July Any over- or underapplied overhead is written off to Cost of Goods Sold.

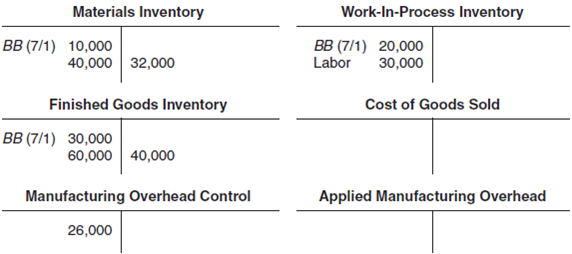

Partially completed T-accounts and additional information for Tigers, Inc., for the month of July follow.

Additional information for July follows:

•Labor wage rate was $30 per hour.

•Manufacturing overhead is applied at $24 per direct labor-hour.

•During the month, sales revenue was $90,000, and selling and administrative costs were $16,000.

•This company has no indirect materials or supplies.

Required

a. What cost amount of direct materials was issued to production during July

b. How much manufacturing overhead was applied to products during July

c. What was the cost of products completed during July

d. What was the balance of the Work-in-Process Inventory account at the end of July

e. What was the over- or underapplied manufacturing overhead for July

f. What was the operating profit for July Any over- or underapplied overhead is written off to Cost of Goods Sold.

Explanation

a.

From the given T-account in the quest...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255