Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 38

Activity-Based Costing: Cost Flows through T-Accounts

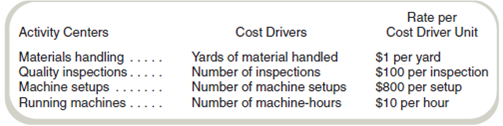

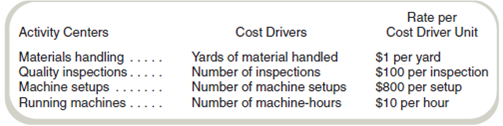

Carolina Fashions, a shirt manufacturer, recently switched to activity-based costing from the department product costing method. The manager of Building S, which manufactures the shirts, has identified the following cost drivers and rates for overhead:

Direct materials costs were $200,000 and direct labor costs were $100,000 during October, when Building S handled 40,000 yards of materials, made 800 inspections, had 100 setups, and ran the machines for 20,000 hours.

Required

Use T-accounts to show the flow of materials, labor, and overhead costs from the four overhead activity centers through Work-in-Process Inventory and out to Finished Goods Inventory. Use the accounts Materials Inventory, Wages Payable, Work-in-Process Inventory, Finished Goods Inventory, and four overhead applied accounts.

Carolina Fashions, a shirt manufacturer, recently switched to activity-based costing from the department product costing method. The manager of Building S, which manufactures the shirts, has identified the following cost drivers and rates for overhead:

Direct materials costs were $200,000 and direct labor costs were $100,000 during October, when Building S handled 40,000 yards of materials, made 800 inspections, had 100 setups, and ran the machines for 20,000 hours.

Required

Use T-accounts to show the flow of materials, labor, and overhead costs from the four overhead activity centers through Work-in-Process Inventory and out to Finished Goods Inventory. Use the accounts Materials Inventory, Wages Payable, Work-in-Process Inventory, Finished Goods Inventory, and four overhead applied accounts.

Explanation

Prepare T- accounts to show the flow of ...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255