Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 8

Activity-Based Costing and Predetermined Overhead Rates

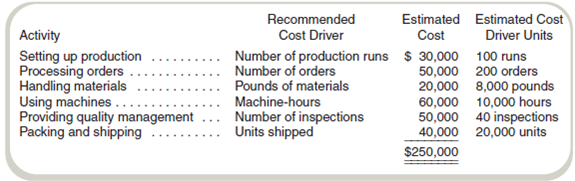

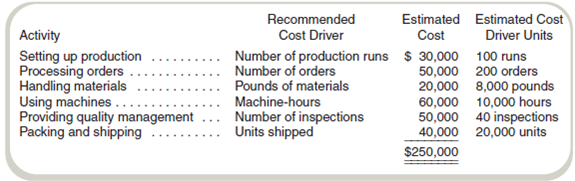

College Supply Company (CSC) makes three types of drinking glasses: short, medium, and tall. It presently applies overhead using a predetermined rate based on direct labor-hours. A group of company employees recommended that CSC switch to activity-based costing and identified the following activities, cost drivers, estimated costs, and estimated cost driver units for Year 5 for each activity center.

In addition, management estimated 2,000 direct labor-hours for Year 5.

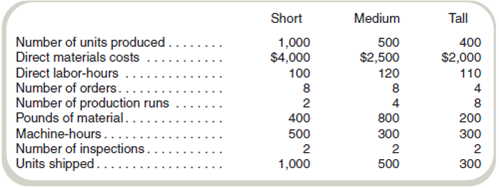

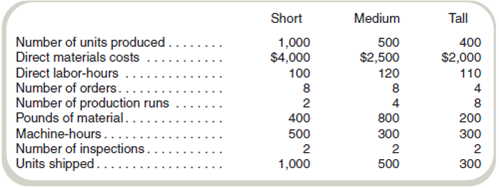

Assume that the following cost driver volumes occurred in February Year 5:

Direct labor costs were $20 per hour.

Required

a. Compute a predetermined overhead rate for Year 5 for each cost driver recommended by the employees. Also compute a predetermined rate using direct labor-hours as the allocation base.

b. Compute the production costs for each product for February using direct labor-hours as the allocation base and the predetermined rate computed in requirement ( a ).

c. Compute the production costs for each product for February using the cost drivers recommended by the employees and the predetermined rates computed in requirement ( a ). ( Note: Do not assume that total overhead applied to products in February will be the same for activity-based costing as it was for the labor-hour-based allocation.)d. Management has seen your numbers and wants an explanation for the discrepancy between the product costs using direct labor-hours as the allocation base and the product costs using activity-based costing. Write a brief response to management.

College Supply Company (CSC) makes three types of drinking glasses: short, medium, and tall. It presently applies overhead using a predetermined rate based on direct labor-hours. A group of company employees recommended that CSC switch to activity-based costing and identified the following activities, cost drivers, estimated costs, and estimated cost driver units for Year 5 for each activity center.

In addition, management estimated 2,000 direct labor-hours for Year 5.

Assume that the following cost driver volumes occurred in February Year 5:

Direct labor costs were $20 per hour.

Required

a. Compute a predetermined overhead rate for Year 5 for each cost driver recommended by the employees. Also compute a predetermined rate using direct labor-hours as the allocation base.

b. Compute the production costs for each product for February using direct labor-hours as the allocation base and the predetermined rate computed in requirement ( a ).

c. Compute the production costs for each product for February using the cost drivers recommended by the employees and the predetermined rates computed in requirement ( a ). ( Note: Do not assume that total overhead applied to products in February will be the same for activity-based costing as it was for the labor-hour-based allocation.)d. Management has seen your numbers and wants an explanation for the discrepancy between the product costs using direct labor-hours as the allocation base and the product costs using activity-based costing. Write a brief response to management.

Explanation

Activity based Costing: Activity based c...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255