Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 11

Choosing an Activity-Based Costing System

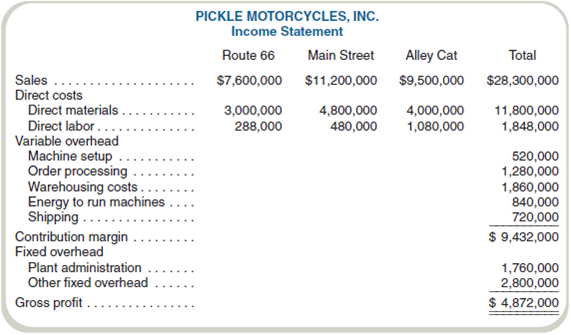

Pickle Motorcycles, Inc. (PMI), manufactures three motorcycle models: a cruising bike (Route 66), a street bike (Main Street), and a starter model (Alley Cat). Because of the different materials used, production processes for each model differ significantly in terms of machine types and time requirements. Once parts are produced, however, assembly time per unit required for each type of bike is similar. For this reason, PMI allocates overhead on the basis of machine-hours. Last year, the company shipped 1,000 Route 66s, 4,000 Main Streets, and 10,000 Alley Cats and had the following revenues and expenses:

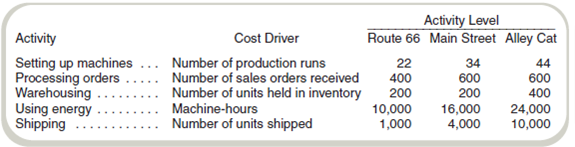

PMI's chief financial officer (CFO) hired a consultant to recommend cost allocation bases. The consultant recommended the following:

The consultant found no basis for allocating the plant administration and other fixed overhead costs and recommended that these not be applied to products.

Required

a. Using machine-hours to allocate production overhead, complete the income statement for Pickle Motorcycles. (See the "using energy" activity for machine-hours.) Do not attempt to allocate plant administration or other fixed overhead.

b. Complete the income statement using the bases recommended by the consultant.

c. How might activity-based costing result in better decisions by Pickle Motorcycles's management

d. After hearing the consultant's recommendations, the CFO decides to adopt activity-based costing but expresses concern about not allocating some of the overhead to the products (plant administration and other fixed overhead). In the CFO's view, "Products have to bear a fair share of all overhead or we won't be covering all of our costs." How would you respond to this comment

Pickle Motorcycles, Inc. (PMI), manufactures three motorcycle models: a cruising bike (Route 66), a street bike (Main Street), and a starter model (Alley Cat). Because of the different materials used, production processes for each model differ significantly in terms of machine types and time requirements. Once parts are produced, however, assembly time per unit required for each type of bike is similar. For this reason, PMI allocates overhead on the basis of machine-hours. Last year, the company shipped 1,000 Route 66s, 4,000 Main Streets, and 10,000 Alley Cats and had the following revenues and expenses:

PMI's chief financial officer (CFO) hired a consultant to recommend cost allocation bases. The consultant recommended the following:

The consultant found no basis for allocating the plant administration and other fixed overhead costs and recommended that these not be applied to products.

Required

a. Using machine-hours to allocate production overhead, complete the income statement for Pickle Motorcycles. (See the "using energy" activity for machine-hours.) Do not attempt to allocate plant administration or other fixed overhead.

b. Complete the income statement using the bases recommended by the consultant.

c. How might activity-based costing result in better decisions by Pickle Motorcycles's management

d. After hearing the consultant's recommendations, the CFO decides to adopt activity-based costing but expresses concern about not allocating some of the overhead to the products (plant administration and other fixed overhead). In the CFO's view, "Products have to bear a fair share of all overhead or we won't be covering all of our costs." How would you respond to this comment

Explanation

Activity based Costing: Activity based c...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255