Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700 Exercise 40

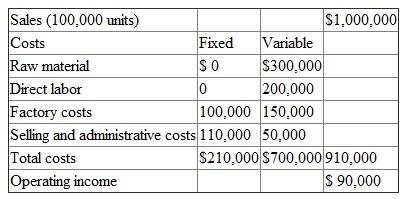

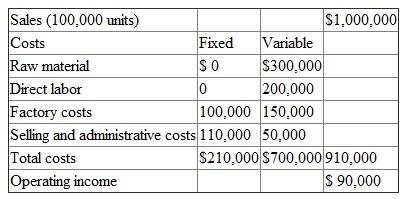

Data for the Bidwell Company are as follows:

Required:

Required:

a. Based on the preceding data, calculate break-even sales in units.

b. If Bidwell Company is subject to an effective income tax rate of 40 percent, calculate the number of units Bidwell would have to sell to earn an after-tax profit of $90,000.

c. If fixed costs increase $31,500 with no other cost or revenue factors changing, calculate the break-even sales in units.

Required:

Required: a. Based on the preceding data, calculate break-even sales in units.

b. If Bidwell Company is subject to an effective income tax rate of 40 percent, calculate the number of units Bidwell would have to sell to earn an after-tax profit of $90,000.

c. If fixed costs increase $31,500 with no other cost or revenue factors changing, calculate the break-even sales in units.

Explanation

Breakeven point is a point where forecas...

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255