Auditing and Assurance Services 9th Edition by Alvin Arens,Mark Beasley,Randy Elder

Edition 9ISBN: 978-0130459206

Auditing and Assurance Services 9th Edition by Alvin Arens,Mark Beasley,Randy Elder

Edition 9ISBN: 978-0130459206 Exercise 12

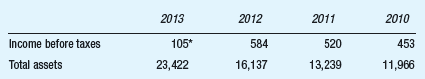

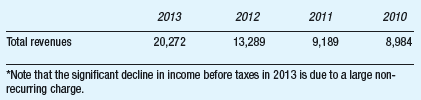

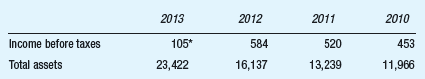

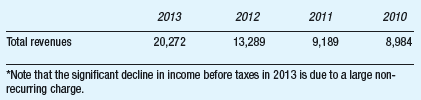

You are the audit manager for Ken-Ron Enterprises. Your firm has been the entity's auditor for 15 years. Your firm normally uses a range of 3% to 5% of income before taxes to calculate overall materiality and 50-75% of overall materiality to calculate tolerable misstatement. Ken-Ron has reported the following financial statement data (in millions) for the last four years:

Required:

a. If you planned on using income before taxes as the benchmark to compute overall materiality and tolerable misstatement, how would you compute those amounts for 2013? Prepare and justify your calculations.

b. Determine overall materiality and tolerable misstatement using either total assets or total revenues as the benchmark. Make the calculations by utilizing both.25% and 2%, the endpoints of the range that your firm's guidance provides.

c. Assume that during the course of the 2013 audit you discovered misstatements totaling $50 million (approximately 50% of the 2013 income before taxes of $105 million). Discuss whether this amount of misstatement is material given your benchmark calculations from parts a. and b. above.

Required:

a. If you planned on using income before taxes as the benchmark to compute overall materiality and tolerable misstatement, how would you compute those amounts for 2013? Prepare and justify your calculations.

b. Determine overall materiality and tolerable misstatement using either total assets or total revenues as the benchmark. Make the calculations by utilizing both.25% and 2%, the endpoints of the range that your firm's guidance provides.

c. Assume that during the course of the 2013 audit you discovered misstatements totaling $50 million (approximately 50% of the 2013 income before taxes of $105 million). Discuss whether this amount of misstatement is material given your benchmark calculations from parts a. and b. above.

Explanation

Auditing and Assurance Services 9th Edition by Alvin Arens,Mark Beasley,Randy Elder

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255