Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 37

Anderson acquires 10 percent of the outstanding voting shares of Barringer on January 1, 2013, for $92,000 and categorizes the investment as an available-for-sale security. An additional 20 percent of the stock is purchased on January 1, 2014, for $210,000, which gives Anderson the ability to significantly influence Barringer. Barringer has a book value of $800,000 at January 1, 2013, and records net income of $180,000 for that year. Barringer declared and paid dividends of $80,000 during 2013. The book values of Barringer's asset and liability accounts are considered as equal to fair values except for a copyright whose value accounted for Anderson's excess cost in each purchase. The copyright had a remaining life of 16 years at January 1, 2013.

Barringer reported $210,000 of net income during 2014 and $230,000 in 2015. Dividends of $100,000 are declared and paid in each of these years. Anderson uses the equity method.

a. On its 2015 comparative income statements, how much income would Anderson report for 2013 and 2014 in connection with the company's investment in Barringer

b. If Anderson sells its entire investment in Barringer on January 1, 2016, for $400,000 cash, what is the impact on Anderson's income

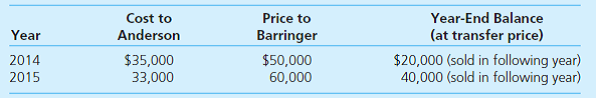

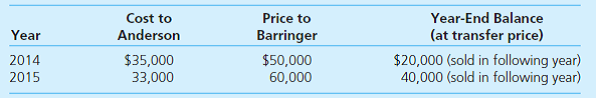

c. Assume that Anderson sells inventory to Barringer during 2014 and 2015 as follows:

What amount of equity income should Anderson recognize for the year 2015

Barringer reported $210,000 of net income during 2014 and $230,000 in 2015. Dividends of $100,000 are declared and paid in each of these years. Anderson uses the equity method.

a. On its 2015 comparative income statements, how much income would Anderson report for 2013 and 2014 in connection with the company's investment in Barringer

b. If Anderson sells its entire investment in Barringer on January 1, 2016, for $400,000 cash, what is the impact on Anderson's income

c. Assume that Anderson sells inventory to Barringer during 2014 and 2015 as follows:

What amount of equity income should Anderson recognize for the year 2015

Explanation

A Company has acquired 10% of the voting...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255