Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 16

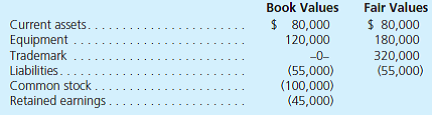

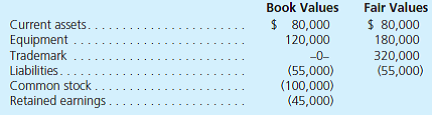

In a pre-2009 business combination, Acme Company acquired all of Brem Company's assets and liabilities for cash. After the combination Acme formally dissolved Brem. At the acquisition date, the following book and fair values were available for the Brem Company accounts:

In addition, Acme paid an investment bank $25,000 cash for assistance in arranging the combination.

a. Using the legacy purchase method for pre-2009 business combinations, prepare Acme's entry to record its acquisition of Brem in its accounting records assuming the following cash amounts were paid to the former owners of Brem:

1. $610,000

2. $425,000

b. How would these journal entries change if the acquisition occurred post-2009 and therefore Acme applied the acquisition method

In addition, Acme paid an investment bank $25,000 cash for assistance in arranging the combination.

a. Using the legacy purchase method for pre-2009 business combinations, prepare Acme's entry to record its acquisition of Brem in its accounting records assuming the following cash amounts were paid to the former owners of Brem:

1. $610,000

2. $425,000

b. How would these journal entries change if the acquisition occurred post-2009 and therefore Acme applied the acquisition method

Explanation

(a)

(1) Company B will dissolve and cea...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255