Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 6

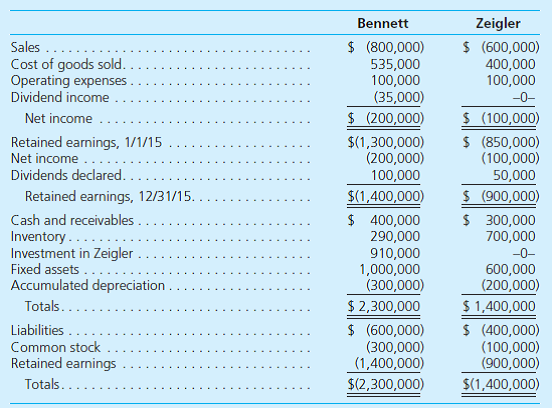

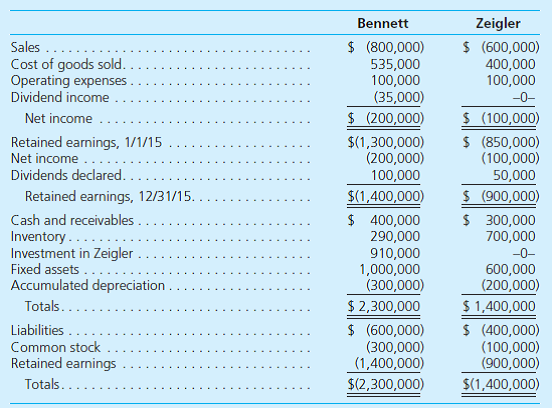

Bennett acquired 70 percent of Zeigler on June 30, 2014, for $910,000 in cash. Based on Zeigler's acquisition-date fair value, only one unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10,000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $390,000 at the acquisition date. The 2015 financial statements are as follows:

Bennett sold Zeigler inventory costing $72,000 during the last six months of 2014 for $120,000. At year-end, 30 percent remained. Bennett sells Zeigler inventory costing $200,000 during 2015 for $250,000. At year-end, 20 percent is left. With these facts, determine the consolidated balances for the following:

Sales

Cost of Goods Sold

Operating Expenses

Dividend Income

Net Income Attributable to Noncontrolling Interest

Inventory

Noncontrolling Interest in Subsidiary, 12/31/15

Bennett sold Zeigler inventory costing $72,000 during the last six months of 2014 for $120,000. At year-end, 30 percent remained. Bennett sells Zeigler inventory costing $200,000 during 2015 for $250,000. At year-end, 20 percent is left. With these facts, determine the consolidated balances for the following:

Sales

Cost of Goods Sold

Operating Expenses

Dividend Income

Net Income Attributable to Noncontrolling Interest

Inventory

Noncontrolling Interest in Subsidiary, 12/31/15

Explanation

Calculation of consolidated Sales

Paren...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255